Heirs Relief Program

What is a tax lien associated with the Heirs Relief Program?

The Property Appraiser’s office has a duty to put a tax lien on your property if you received a tax exemption or assessment limitation up to the past 10 years that you were not entitled to. The Property Appraiser’s office will notify you that taxes with penalties and interest are due. You will have 30 days to pay before a lien is recorded.

In this case, an improper exemption refers to when the original exemption applicant has passed away, and our office has not been notified by the remaining heir(s). When a property is classified as “heirs” property, ” the original owner is deceased, and the property must be probated to establish new ownership.

Since exemptions are individually granted, the exemption must be removed when a person passes away. Failure to notify our office that the original property owner is deceased can result in a tax lien of up to 10 years with a penalty of 50% of the escaped taxes and 15% interest for each year up to 10 years. However, the Alachua County Property Appraiser, Ayesha Solomon, offers relief on penalties and interest on heirs’ properties for individuals who voluntarily notify our office of their improperly claimed benefits.

What does this look like?

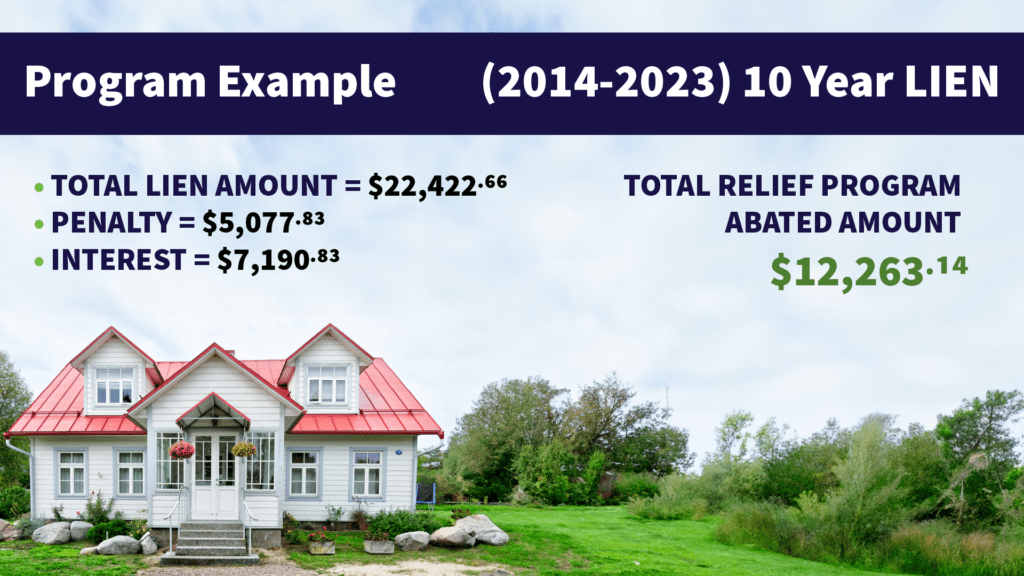

Program Example

In this example, the original owner passed away 20 years ago, and the property was inherited by family members who were unaware of the requirement to notify the Property Appraiser’s office. The deceased owner’s heirs later attended an ACPA Probate & Estate Planning Summit, where they discovered that the exemption on their late relative’s home had been illegally renewed. Upon learning this, they promptly brought the issue to the attention of the ACPA office, acknowledging that the exemption had been improperly maintained due to the automatic renewal process. Seeking resolution, they requested to be covered under the Heirs Relief Program.

(2014- 2023) 10-year Lien

Total Lien Original Amount = $22,422.66

Penalty = $5,077.83

Interest = $7,190.83

Total Relief Program Abated Amount: $12,263.14

When Should I Report this to the Property Appraiser‘s Office?

You should immediately report to our office when the original exemptee has passed away to remove the exemption(s). Our office mails auto-renewal letters to all properties with exemptions every year. This letter will list the name of the exemptee or whom the exemption is on behalf of according to our records. When you receive this renewal letter, and it is in a deceased person‘s name, this is considered an improper exemption.

How to report this to our office?

Please complete this form to notify our office if an exemption is claimed on the deceased owner‘s behalf. Our office offers relief on penalties and interest on heirs’ properties for individuals who voluntarily inform our office of their improperly claimed benefits. You may be required to provide a copy of the Short Form Death Certificate.

Heirs Homestead Exemption Application Process

Heirs must complete the probate process to establish ownership. However, an heir may apply for the Homestead Exemption before starting the probate. Our office will hold on to the application until the proceedings are complete. If all Homestead Exemption requirements are met, the application held by our office during the probate proceedings will be retroactively applied to the property from the year the application was received.

What are the requirements for Homestead Exemption?

- Property Ownership as of January 1 (legal/equitable title)

- The owner (or others legally or naturally dependent upon such person) must be a US citizen or Permanent US resident and Florida resident as of January 1

- Permanent residence on the property as of January 1. Permanent residence is determined by:

- Occupying the property

- Having an updated Florida Driver’s License/ID card reflecting the property’s address

- If you are registered to vote, your registration must be updated to reflect the property address on your application.

- Having proof of payment of utility bill in your name showing usage for the property address