ACPA Resources

Here are some resources to help with your property journey!

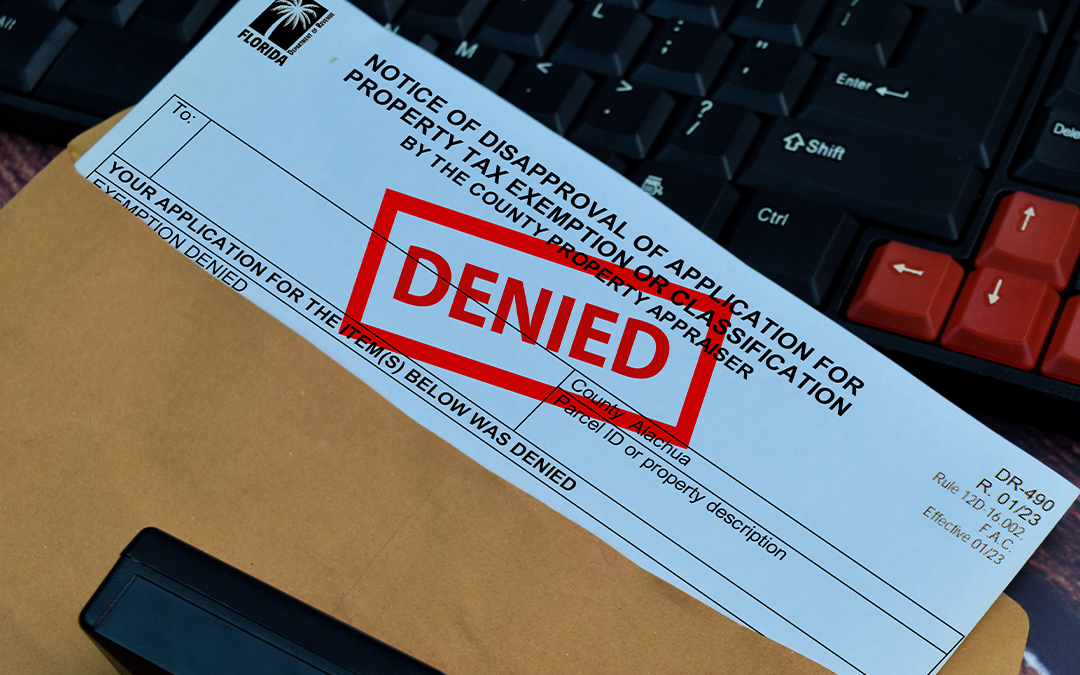

What is a Denial

A “denial” refers to the process by which the Property Appraiser’s Office denies an applicant’s applications for certain tax exemptions, such as homestead, veterans, or senior-related benefits, as well as agricultural classifications.

When a person has been notified of an exemption denial by registered mail, they have until 25 days after the mailing of their TRIM notice to file an appeal with the Value Adjustment Board (VAB). There is no filing fee for applicants who have been denied a homestead exemption application unless the denial is for a late file. If the petitioner is appealing a denial of an application that was filed late (after March 1), a nominal filing fee is due.

Helpful Links

Get links to additional resources like different Alachua County, State of Florida, and National Resources. Also, check out links to different County Property Appriasers.

Tangible Personal Property Instructional Video

Understand the Tangible Personal Property Tax Return better with our instructional video!

Florida Taxpayer’s Bill of Rights

Do you know your rights under Florida Law? Download and view GT-800039 – Florida Taxpayer’s Bill of Rights.

Appraisal Definitions

Explore our library of appraisal terms and definitions and understand the concepts and principles of property appraisal. Get familiar with the terms and definitions used at the Alachua County Property Appraiser’s Office. It clicking a term and learn about its definition.

How Property Taxes Work

Learn more about property appraisals and property tax work. Get educated on subjects such as the many duties of the Property Appraiser, how the appraisal process works, how the market value is determined, how property taxes are calculated, how Amendment 10 affects our property taxes, and more!

Exemption Guide

Have questions about Property Exemptions? Check our exemptions guide. Learn what is homestead exemptions, how to qualify for homestead, what if you miss a deadline, and more!

Property Resources

Welcome to our property resource center ONLINE! Get tips on “Understanding My Property’s Value”, “Understanding Exemptions, Discounts, and Classifications”, and “File a Request!”

Legislative Updates

Stay up-to-date on Florida Constitutional Amendments!

Helpful Links

Get links to additional resources like different Alachua County, State of Florida, and National Resources. Also, check out links to different County Property Appriasers.

Tangible Personal Property Instructional Video

Understand the Tangible Personal Property Tax Return better with our instructional video!

Florida Taxpayer’s Bill of Rights

Do you know your rights under Florida Law? Download and view GT-800039 – Florida Taxpayer’s Bill of Rights.

Appraisal Definitions

Explore our library of appraisal terms and definitions and understand the concepts and principles of property appraisal. Get familiar with the terms and definitions used at the Alachua County Property Appraiser’s Office. It clicking a term and learn about its definition.

How Property Taxes Work

Learn more about property appraisals and property tax work. Get educated on subjects such as the many duties of the Property Appraiser, how the appraisal process works, how the market value is determined, how property taxes are calculated, how Amendment 10 affects our property taxes, and more!

Exemption Guide

Have questions about Property Exemptions? Check our exemptions guide. Learn what is homestead exemptions, how to qualify for homestead, what if you miss a deadline, and more!