Welcome to ACPA Community Outreach

Here you can find news, events, and additional resources!

Outreach News

Newberry Mobile Pop-up

GAINESVILLE, Fla - Starting Monday, January 22, 2024, through Friday, February 02, 2024, the Alachua County Property Appraiser’s Office is expanding its operations to the City of Newberry by hosting a mobile pop-up at the Mentholee Norfleet Municipal Building. The...

‘Get your legal matters in order’: Assisting Alachua County property owners in the battle against property loss.

GAINESVILLE, Fla - Nearly 3 in 100 residential properties in the northwest Gainesville zip codes 32605 and 32653 are at risk of entering the costly and lengthy probate legal process. To help combat these issues the Alachua County Property Appraiser’s Office will be...

Alachua County Alachua & High Springs Probate and Estate Planning Summit

GAINESVILLE, Fla - Nearly 1 in 25 residential properties in the cities of Alachua and High Springs are at risk of entering the costly and lengthy probate legal process.The Alachua County Property Appraiser’s Office will be hosting its third Probate and Estate Planning...

Tangible Personal Property Webinar

Tangible Personal Property:What Every Business Owner Needs to Know Wednesday, January 11 @ 12:00 pm EST Join our webinar to learn more about Tangible Personal Property and why it is important for your business. Learn about what is tangible personal property, how the...

Critical Public Service Additional Homestead Exemption

GAINESVILLE, Fla - A Critical Public Services Workforce bill is pending approval by Florida voters and if passed will provide an additional exemption for qualifying applicants and will take effect January 1, 2023. This bill may provide an additional Homestead...

The International Association of Assessing Officers Reward the Alachua County Property Appraiser’s Office

GAINESVILLE, Fla - The International Association of Assessing Officers (IAAO) announced the Alachua County Property Appraiser’s Office as the recipient of the 2022 Certificate of Excellence in Assessment Administration. This prestigious award was presented during the...

Alachua County Property Appraiser’s Office Introduces New Software for Homestead Exemption Monitoring

GAINESVILLE, Fla - The Alachua County Property Appraiser’s Office is excited to introduce TrueRoll, a software used for monitoring homestead exemption, to its internal processes on October 1, 2022. This software will be used to detect incorrect filings and fraudulent...

Alachua County Hawthorne Probate and Estate Planning Summit

GAINESVILLE, Fla - About 1 in 20 residential properties in the city of Hawthorne are at risk of entering the costly and lengthy probate legal process.The Alachua County Property Appraiser’s Office will be hosting its second Probate and Estate Planning Summit on August...

Outreach Events

Extended Hours

Ongoing Community InitiativesWe know our TRIM season is busy, so to be more accessible, we will be extending our hours from August 26 - to August 30 from 5 p.m. - to 7 p.m. We will be available to assist the public with any needs from our office. No appointments are...

Mobile Pop-Up @ Newberry!

Ongoing Community Education InitiativesMobile Pop-up @ Newberry AboutIn continuing to support our constituents in Alachua County, we’re excited to be collaborating with the City of Newberry by hosting a mobile pop-up at the Mentholee Norfleet Municipal Building!...

Probate and Estate Planning Workshop

Our Probate and Estate Planning Summit was established in early 2022. We have since had multiple summits throughout the county and have seen a continuous increase in public turnout. With only averaging two summits a year, we have found that a secondary forum is...

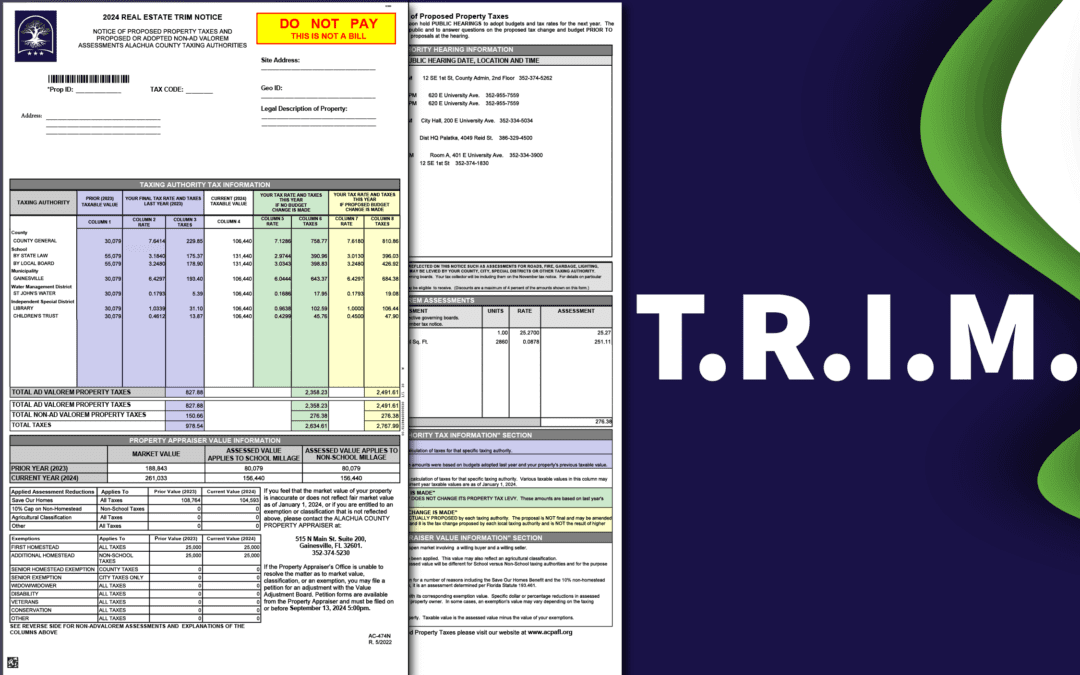

What is a TRIM notice?

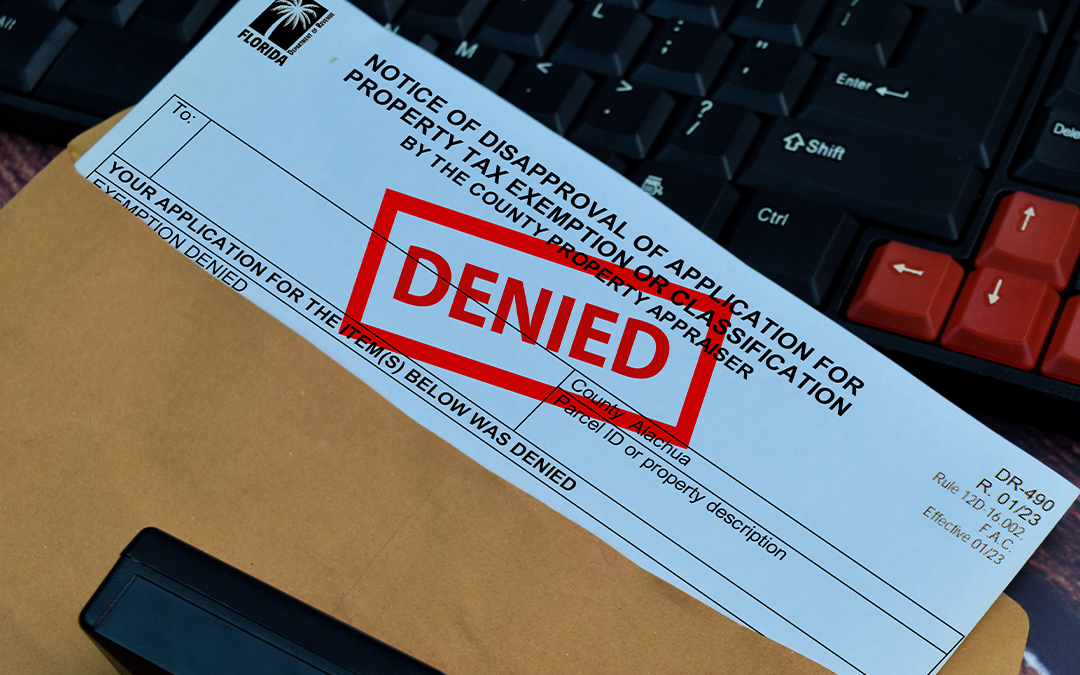

A “denial” refers to the process by which the Property Appraiser’s Office denies an applicant’s applications for certain tax exemptions, such as homestead, veterans, or senior-related benefits, as well as agricultural classifications.

When a person has been notified of an exemption denial by registered mail, they have until 25 days after the mailing of their TRIM notice to file an appeal with the Value Adjustment Board (VAB). There is no filing fee for applicants who have been denied a homestead exemption application unless the denial is for a late file. If the petitioner is appealing a denial of an application that was filed late (after March 1), a nominal filing fee is due.

Tips to Understand Where Your Property Taxes Come From

Tips To Understand Where Your Property Taxes Come FromProperty taxes vs property value (AV and MV)Unless there is a change of ownership, exempt status, or a significant improvement on the property, the Assessed Value (AV) of a homestead property can only increase a...

What is a Denial

A “denial” refers to the process by which the Property Appraiser’s Office denies an applicant’s applications for certain tax exemptions, such as homestead, veterans, or senior-related benefits, as well as agricultural classifications.

When a person has been notified of an exemption denial by registered mail, they have until 25 days after the mailing of their TRIM notice to file an appeal with the Value Adjustment Board (VAB). There is no filing fee for applicants who have been denied a homestead exemption application unless the denial is for a late file. If the petitioner is appealing a denial of an application that was filed late (after March 1), a nominal filing fee is due.

Helpful Links

Get links to additional resources like different Alachua County, State of Florida, and National Resources. Also, check out links to different County Property Appriasers.

Tangible Personal Property Instructional Video

Understand the Tangible Personal Property Tax Return better with our instructional video!