ACPA Community Outreach News & Updates

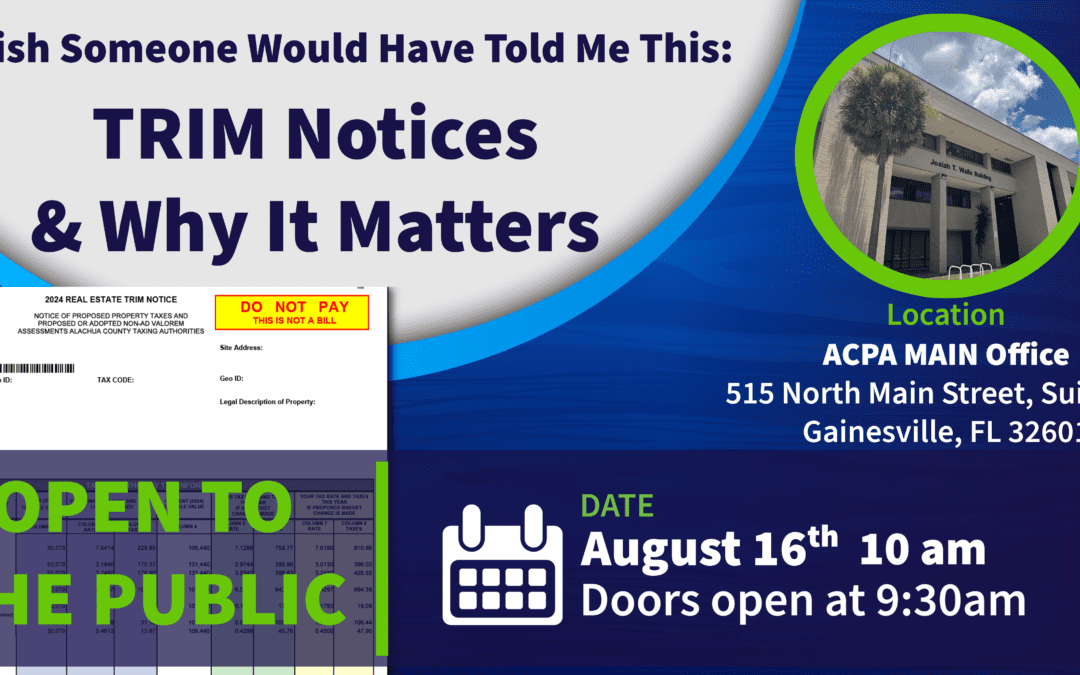

I Wish Someone Would Have Told Me This: TRIM Notices & Why It Matters

Join our workshop “I Wish Someone Would Have Told Me This: TRIM Notices & Why It Matters”

Understanding Your TRIM Notice: Free Info Session for Homeowners

Curious about what a TRIM Notice is and how it affects your property taxes? Join us for a free in-person info session designed to help Alachua County homeowners better understand the annual Truth in Millage (TRIM) Notice before it arrives in the mail.

During this workshop, we’ll break down:

- What the TRIM Notice includes and how to read it

- How your property value is determined

- What exemptions may be available to reduce your future tax bill

Whether you’re a first-time homeowner or just looking for clarity, this session is a great opportunity to get your questions answered and take control of your property information before the notice hits your mailbox.

Open to all Alachua County residents.

New Builds, New Bills: What Every Homeowner Should Know About Property Taxes in a Growing Alachua County

As Alachua County continues to grow, so do questions about how new development affects property taxes. Whether you’re new to your home or living in a recently developed neighborhood, your next property tax bill might look different than expected. We’re here to help you understand why.

New Builds, New Bills is an ongoing initiative from the Alachua County Property Appraiser’s Office, created to keep residents informed about how growth and development impact property taxes. Through community sessions and continued outreach, this initiative reflects our commitment to proactive education and transparent service.

Why Attend

In just the past two years, the cities of Alachua and Newberry have seen significant growth:

Alachua has added four new subdivisions with more than 320 residential lots approved for development.

Newberry has approved ten new subdivisions, bringing over 580 residential lots to the area.

As neighborhoods grow, property values shift, and with them, property tax responsibilities. With TRIM Notices being mailed soon, now is the time to learn what to expect.

What You’ll Learn

- Why your taxes might increase even if the millage rate doesn’t

- How to read and understand your TRIM Notice

- How to apply for a Homestead Exemption and potentially save money

- What to expect in the coming years as growth continues

- How the Property Appraiser’s Office works to serve you

These sessions are especially helpful if you live in a newly built home or a recently developed subdivision. Understanding your property taxes now can help you plan ahead with confidence.

Event Information

Alachua Session

Tuesday, July 29 at 6 p.m.

James A. Lewis City Commission Chambers

Alachua City Hall

15100 NW 142 Ter. Alachua, FL 32615

Newberry Session

Thursday, July 31 at 6 p.m.

City of Newberry Municipal Building

25420 W Newberry Rd. Newberry, FL 32669

Alachua County Property Appraiser’s Office Relaunches Title Alert Service to Monitor Property Ownership Changes: Don’t Fall Victim to Deed Fraud

GAINESVILLE, Fla –

The Alachua County Property Appraiser’s Office has relaunched its free property monitoring service, now called Title Alert.

This office has mailed a notification regarding this service to all eligible real property parcels in Alachua County. This updated service, previously known as Property Watch, offers subscribers automated notifications when there are any recorded changes in property ownership.

It is now available to everyone, not just property owners, and offers added protection against potential fraudulent property transactions. However, those who own a confidential parcel must verify their identity in person at the Property Appraiser’s office by providing a valid driver’s license or ID to register for this service. To register for Title Alert, visit the Property Appraiser’s website at www.acpafl.org.

During the registration process, you must provide the Prop. ID for the property being monitored and a contact method (phone number or email). Prop. ID numbers can be found on our website by performing a property search using the owner’s name, property address, or parcel number.

Once registered, subscribers can choose how to receive alerts—via phone call, text, email, or postal mail. Postal mail alerts will be delayed due to the manual process involved. The system will continuously monitor the property for changes in ownership, and subscribers will be notified immediately if any changes occur.

If a property owner makes an ownership change, they will receive a confirmation, and no further action is necessary. However, if they did not initiate the change, they are encouraged to contact the Property Appraiser’s Office immediately.

“The Title Alert service is part of our ongoing commitment to protect property owners and residents in Alachua County,” Property Appraiser Ayesha Solomon said. “If you were previously registered for Property Watch, you don’t need to re-register. You will be automatically enrolled in the new service. Property ownership updates will be available on our website within 24 to 48 hours.”

Title Alert may help protect against fraudulent property transactions but is not a substitute for a formal title search. Ownership records are updated based on deeds filed with the Alachua County Official Records. The Property Appraiser’s Office cannot determine if a deed is fraudulent. However, this service may provide an added layer of security. If fraud is suspected, it should be reported to local law enforcement.

About the Alachua County Property Appraiser’s Office

The Alachua County Property Appraiser’s Office ensures that all taxable property in the county is assessed equitably and at its fair market value in accordance with Florida statutes. The Property Appraiser’s Office has two locations: 515 N. Main Street in Gainesville and 15010 NW 142nd Terrace in Alachua. For more information visit https://www.acpafl.org

Check out our Events!

Get more information!

New Builds, New Bills: What Every Homeowner Should Know About Property Taxes in a Growing Alachua County

As Alachua County continues to grow, so do questions about how new development affects property taxes. Whether you’re new to your home or living in a recently developed neighborhood, your next property tax bill might look different than expected. We’re here to help you understand why.

New Builds, New Bills is an ongoing initiative from the Alachua County Property Appraiser’s Office, created to keep residents informed about how growth and development impact property taxes. Through community sessions and continued outreach, this initiative reflects our commitment to proactive education and transparent service.

Why Attend

In just the past two years, the cities of Alachua and Newberry have seen significant growth:

Alachua has added four new subdivisions with more than 320 residential lots approved for development.

Newberry has approved ten new subdivisions, bringing over 580 residential lots to the area.

As neighborhoods grow, property values shift, and with them, property tax responsibilities. With TRIM Notices being mailed soon, now is the time to learn what to expect.

What You’ll Learn

- Why your taxes might increase even if the millage rate doesn’t

- How to read and understand your TRIM Notice

- How to apply for a Homestead Exemption and potentially save money

- What to expect in the coming years as growth continues

- How the Property Appraiser’s Office works to serve you

These sessions are especially helpful if you live in a newly built home or a recently developed subdivision. Understanding your property taxes now can help you plan ahead with confidence.

Event Information

Alachua Session

Tuesday, July 29 at 6 p.m.

James A. Lewis City Commission Chambers

Alachua City Hall

15100 NW 142 Ter. Alachua, FL 32615

Newberry Session

Thursday, July 31 at 6 p.m.

City of Newberry Municipal Building

25420 W Newberry Rd. Newberry, FL 32669

Alachua County Property Appraiser’s Office Relaunches Title Alert Service to Monitor Property Ownership Changes: Don’t Fall Victim to Deed Fraud

GAINESVILLE, Fla –

The Alachua County Property Appraiser’s Office has relaunched its free property monitoring service, now called Title Alert.

This office has mailed a notification regarding this service to all eligible real property parcels in Alachua County. This updated service, previously known as Property Watch, offers subscribers automated notifications when there are any recorded changes in property ownership.

It is now available to everyone, not just property owners, and offers added protection against potential fraudulent property transactions. However, those who own a confidential parcel must verify their identity in person at the Property Appraiser’s office by providing a valid driver’s license or ID to register for this service. To register for Title Alert, visit the Property Appraiser’s website at www.acpafl.org.

During the registration process, you must provide the Prop. ID for the property being monitored and a contact method (phone number or email). Prop. ID numbers can be found on our website by performing a property search using the owner’s name, property address, or parcel number.

Once registered, subscribers can choose how to receive alerts—via phone call, text, email, or postal mail. Postal mail alerts will be delayed due to the manual process involved. The system will continuously monitor the property for changes in ownership, and subscribers will be notified immediately if any changes occur.

If a property owner makes an ownership change, they will receive a confirmation, and no further action is necessary. However, if they did not initiate the change, they are encouraged to contact the Property Appraiser’s Office immediately.

“The Title Alert service is part of our ongoing commitment to protect property owners and residents in Alachua County,” Property Appraiser Ayesha Solomon said. “If you were previously registered for Property Watch, you don’t need to re-register. You will be automatically enrolled in the new service. Property ownership updates will be available on our website within 24 to 48 hours.”

Title Alert may help protect against fraudulent property transactions but is not a substitute for a formal title search. Ownership records are updated based on deeds filed with the Alachua County Official Records. The Property Appraiser’s Office cannot determine if a deed is fraudulent. However, this service may provide an added layer of security. If fraud is suspected, it should be reported to local law enforcement.

About the Alachua County Property Appraiser’s Office

The Alachua County Property Appraiser’s Office ensures that all taxable property in the county is assessed equitably and at its fair market value in accordance with Florida statutes. The Property Appraiser’s Office has two locations: 515 N. Main Street in Gainesville and 15010 NW 142nd Terrace in Alachua. For more information visit https://www.acpafl.org

Constitutional Amendment 5 Annual Inflation Adjustment to Homestead Exemption Value

GAINESVILLE, Fla –

Florida voters approved an annual inflation adjustment to the value of current and future Homestead Exemptions in the November 5, 2024, general election.

This is known as Amendment 5, which takes effect on January 1, 2025, beginning with the 2025 tax year assessment. This applies to levies other than the school district levies and only to homesteaded properties.

Currently, when someone owns the property and makes it his or her permanent residence or the permanent residence of his or her dependent, the property may be eligible for a Homestead Exemption up to $50,000. The first $25,000 applies to all taxing authorities, including school district levies. The second $25,000 starts to apply to properties with an assessed value between $50,000 and $75,000 and only to non-school taxes.

Amendment 5 would only affect the second $25,000 of the Homestead Exemption. The adjusted value

increase amount will be calculated and provided by the Florida Department of Revenue annually based on the Consumer Price Index (CPI) when the inflation adjustment is positive and will accumulate every year. This has no relation to the Save Our Homes (SOH) Cap of 3% or the property’s deferred value.

“For example, if a property’s market value is $275,000 and its assessed value is $130,000, it would qualify for the full $50,000 Homestead Exemption due to the assessed value being more than $75,000,” Property

Appraiser Ayesha Solomon said. “If the CPI for the tax year 2025 were to be 5.1%, it must first be converted

using the formula 1+ (CPI/100). This results in a growth factor of 1.051 that is multiplied by the second

$25,000, which in this case would equal $26,275 for a new total Homestead Exemption value of $51,275.”

“Since these adjustments are cumulative, if the CPI is 4.1% for the following 2026 tax year, this would be

converted to the growth factor 1.041 and multiplied by the previously inflated $26,275 established in 2025,

equating to $27,352. In this case, the new total exemption amount would equal $52,352 for the 2026 tax year, resulting in an ongoing taxable value reduction,” Solomon said.

Property owners with a Homestead Exemption are not required to take any action. These adjustments will

happen automatically. The updates will be available for homeowners to review on the Notice of Proposed Tax forms, also known as Truth in Millage (TRIM) notices, mailed by this office in mid-August each year.

About the Alachua County Property Appraiser’s Office

The Alachua County Property Appraiser’s Office ensures that all taxable property in the county is assessed equitably and at its fair market value in accordance with Florida statutes. The Property Appraiser’s Office has two locations: 515 N. Main Street in Gainesville and 15010 NW 142nd Terrace in Alachua. For more information visit https://www.acpafl.org

Alachua County Property Appraiser Ayesha Solomon Elected President of the Florida Association of Property Appraisers

GAINESVILLE, Fla –

Alachua County Property Appraiser Ayesha Solomon has been elected President of the Florida Association of Property Appraisers (FAPA), a testament to her leadership and dedication to property appraisal.

Her election took place during FAPA’s annual conference, which was hosted this year at Celebration Point in Alachua County. This further solidified the region’s central role in statewide property appraisal leadership. As President, she aims to expand efforts to streamline property tax benefits for seniors, ensuring greater equity and efficiency across Florida’s property appraisal system.

“I am humbled by this opportunity to serve as President of FAPA. This role is not just a personal honor but a reflection of the collective strength of our members and the work we do every day to ensure fairness and equity in property assessments. ” Solomon said. “I want to express my deepest gratitude to outgoing President Marty Kiar for his leadership and dedication. I look forward to working together with my colleagues to continue advancing policies that benefit all Floridians, especially our seniors and vulnerable communities. Together, we will work to build a stronger, more united association.”

Solomon has been an active member of FAPA since 2019 and has held various leadership positions, including serving as Vice President in the past year, where she led the organization’s legislative committee. She will serve as President alongside a distinguished team of officers and directors for the 2024-2025 term, including:

President-elect: Wesley Davis, Indian River County Property Appraiser

Secretary: Jimmy Cowan, Marion County Property Appraiser

Treasurer: Reginald Cunningham, Gadsden County Property Appraiser

Sergeant-at-Arms: Amy Mercado, Orange County Property Appraiser

FAPA is a statewide professional organization representing elected county property appraisers and their staff. It is dedicated to promoting fairness and accuracy in property tax assessments. The association is key in advising the Florida Legislature on policy matters and ensuring that new laws benefit property owners and the appraisal industry.

Under Solomon’s leadership, FAPA will continue to advocate legislative initiatives such as permanently freezing the assessed value for seniors, which reduces administrative burdens for property appraisers and provides stability and protection for low-income seniors, ensuring they can maintain their homes without the threat of rising property taxes.

About the Alachua County Property Appraiser’s Office

The Alachua County Property Appraiser’s Office ensures that all taxable property in the county is assessed equitably and at its fair market value in accordance with Florida statutes. The Property Appraiser’s Office has two locations: 515 N. Main Street in Gainesville and 15010 NW 142nd Terrace in Alachua. For more information visit https://www.acpafl.org

Newberry Mobile Pop-up

GAINESVILLE, Fla –

Starting Monday, January 22, 2024, through Friday, February 02, 2024, the Alachua County Property Appraiser’s Office is expanding its operations to the City of Newberry by hosting a mobile pop-up at the Mentholee Norfleet Municipal Building. The pop- up will be located at 25420 W Newberry Rd, Newberry, FL 32669 between 8 a.m. and 5 p.m. each weekday.

During this time, our office will be available to assist with questions about homestead and other exemptions, agricultural classifications, title and ownership, property fraud detection and more. Appointments are not required during this time and walk-ins are welcome.

“Our office hopes for this mobilization initiative to be the first of many pop-ups,” Property Appraiser, Ayesha Solomon said. “With the continuous growth of the county, we must strive to be as accessible as possible.”

Our office plans to continue to collaborate with neighboring cities and government officials to help determine the best central areas to expand our services throughout the county. We prioritize community involvement.

“Being community driven has always been a priority of this office as we want to ensure we are actively engaging with the communities we serve and gaining direct insight from residents,” Solomon said.

This event is free and will be open to the general public. In addition, this event will be photographed and is subject to later use.

About the Alachua County Property Appraiser’s Office

The Alachua County Property Appraiser’s Office ensures that all taxable property in the county is assessed equitably and at its fair market value in accordance with Florida statutes. The Property Appraiser’s Office has two locations: 515 N. Main Street in Gainesville and 15010 NW 142nd Terrace in Alachua. For more information visit https://www.acpafl.org

‘Get your legal matters in order’: Assisting Alachua County property owners in the battle against property loss.

GAINESVILLE, Fla –

Nearly 3 in 100 residential properties in the northwest Gainesville zip codes 32605 and 32653 are at risk of entering the costly and lengthy probate legal process.

To help combat these issues the Alachua County Property Appraiser’s Office will be hosting its fourth Probate and Estate Planning Summit on Sep 14, 2023, at 6 p.m. This will take place at the Eldercare of Alachua County Senior Center located at 5701 NW 34th Blvd, Gainesville, FL 32653.

This ongoing collaborative initiative serves as an opportunity to be more accessible to residents who may be impacted by these issues. This interactive panel discussion features representatives from the Alachua County Clerk of Court, the Alachua County Tax Collector, the University of Florida Levin College of Law, and Three Rivers Legal Services Inc.

Each panelist will discuss how their respective offices are directly impacted by the extensive probate process, provide insights on preventative measures to help avoid these issues, and answer any questions the audience may have about these processes.

“With this being the fourth summit, we have had the opportunity to travel the county with this information and provide insights on resources,” Property Appraiser, Ayesha Solomon said. “Now we are back in Gainesville which is a major hot spot area for these issues and hope to assist as many residents as possible.”

Iechia Houston, a city of Gainesville resident, began the probate process in July 2022 for a family home located on the southeast side of town. Although it has been over a year since Houston initially started this lengthy process, it is still not complete.

“The most challenging part of this process is not knowing the outcome,” Houston said. “You need to have a plan for when that final day comes so your family doesn’t have to fight to try and keep your property.”

The Alachua County Property Appraiser’s Office formulated this initiative through a dual data-driven approach that identified all the parcels that are classified as heirs’ property throughout the county as well as parcels with only one remaining owner listed on the property suggesting a lack of proper estate planning. After successfully analyzing the data sets, heat maps were created to showcase the “hot spot” areas in the county that are affected the most by these issues.

This event is free and will be open to the general public. In addition, this event will be recorded and is subject to later use.

About the Alachua County Property Appraiser’s Office

The Alachua County Property Appraiser’s Office ensures that all taxable property in the county is assessed equitably and at its fair market value in accordance with Florida statutes. The Property Appraiser’s Office has two locations: 515 N. Main Street in Gainesville and 15010 NW 142nd Terrace in Alachua. For more information visit https://www.acpafl.org

Alachua County Alachua & High Springs Probate and Estate Planning Summit

GAINESVILLE, Fla –

Nearly 1 in 25 residential properties in the cities of Alachua and High Springs are at risk of entering the costly and lengthy probate legal process.

The Alachua County Property Appraiser’s Office will be hosting its third Probate and Estate Planning Summit on February 16, 2023, at 6 p.m. which will take place at the James A. Lewis City Commission Chambers located at 15100 NW 142 Ter. Alachua, FL 32615 inside Alachua City Hall.

This event will feature an interactive panel discussion led by representatives from the Alachua County Clerk of Court, the Alachua County Tax Collector, the University of Florida Levin College of Law, and Three Rivers Legal Services Inc. Each panelist will discuss how their respective offices are directly impacted by the extensive probate process and how individuals can opt to create estate plans that are aimed at allowing assets to pass outside of the probate process.

“As we continue with this ongoing project we hope to impact residents positively while addressing their concerns directly by being more accessible,” Property Appraiser, Ayesha Solomon said. “Overall, we hope to gain more insight into the needs and expectations of the public.”

The Alachua County Property Appraiser’s Office formulated this initiative through a dual data-driven approach that identified all the parcels that are classified as heirs’ property throughout the county as well as parcels with only one remaining owner listed on the property suggesting a lack of proper estate planning. After successfully analyzing the data sets, heat maps were created to showcase the “hot spot” areas in the county that are affected the most by these issues.

“We are thankful for Ayesha Solomon and her team at the Alachua County Property Appraiser’s Office,” Ashley Stathatos, High Springs City Manager, said. “This is a much-needed and worthwhile service for our residents. We look forward to further resources being made available to our citizens in Alachua and High Springs in the future.”

This event is free and will be open to the general public. In addition, this event will be recorded and subject to later use.

About the Alachua County Property Appraiser’s Office

The Alachua County Property Appraiser’s Office ensures that all taxable property in the county is assessed equitably and at its fair market value in accordance with Florida statutes. The Property Appraiser’s Office has two locations: 515 N. Main Street in Gainesville and 15010 NW 142nd Terrace in Alachua. For more information visit https://www.acpafl.org

Tangible Personal Property Webinar

Tangible Personal Property:

What Every Business Owner Needs to Know

Wednesday, January 11 @ 12:00 pm EST

Join our webinar to learn more about Tangible Personal Property and why it is important for your business. Learn about what is tangible personal property, how the process works for the Property Appraiser’s office, how to file a tangible personal property tax return, and more.

This event is open but you are required to register. Submitting your questions during registration will give your questions priority.

Critical Public Service Additional Homestead Exemption

A Critical Public Services Workforce bill is pending approval by Florida voters and if passed will provide an additional exemption for qualifying applicants and will take effect January 1, 2023.

This bill may provide an additional Homestead Exemption of up to $50,000 on the assessed valuation greater than $100,000 and up to $150,000. This applies to classroom teachers, law enforcement officers, correctional officers, firefighters, emergency medical technicians, paramedics, child welfare services professionals, active-duty members of the United States Armed Forces, and members of the Florida National Guard.

If this bill takes effect, applicants must be an active Critical Public Service employee as of January 1 each year. This exemption does not apply to those who are working part-time, retired, or who are not in the explicit professions listed above. Proof of full-time employment in specified fields of work must be attached to the application and any other necessary information to verify eligibility for the exemption.

In addition, qualifying applicants must already have the original Homestead Exemption, can only legally obtain one exemption per family unit, and must apply for the exemption by March 1 each year. This additional exemption is not subject to auto-renewal and requires a verification process from our office each year.

“If this additional exemption is passed, we do not anticipate a major shift in our office processes as there are numerous exemptions available from our office that require a verification process each year due to them not being eligible for auto-renewal,” Property Appraiser, Ayesha Solomon said.

If approved this would be the first time an exemption of this nature has been put in place for Florida property owners who have maintained residency in the state.

“Our office strives to remain transparent about the parameters applicants would need to meet in order to actually obtain this additional exemption,” Solomon said. “It is important that voters are fully aware of these requirements to help ensure that they are well informed when placing their votes.”

For property owners who are interested in monitoring their residential property, our office has released a monitoring software service called Property Watch. Property owners can sign up for this service through our website. After this registration process, owners can expect this service to continuously monitor their property. The areas that will be monitored for changes include the owner’s name, the mailing address, any change in exemption or agricultural classification status, and splits and combines to parcels.

About the Alachua County Property Appraiser’s Office

The Alachua County Property Appraiser’s Office ensures that all taxable property in the county is assessed equitably and at its fair market value in accordance with Florida statutes. The Property Appraiser’s Office has two locations: 515 N. Main Street in Gainesville and 15010 NW 142nd Terrace in Alachua. For more information visit https://www.acpafl.org

The International Association of Assessing Officers Reward the Alachua County Property Appraiser’s Office

GAINESVILLE, Fla –

The International Association of Assessing Officers (IAAO) announced the Alachua County Property Appraiser’s Office as the recipient of the 2022 Certificate of Excellence in Assessment Administration.

This prestigious award was presented during the Awards and Recognition Ceremony at IAAO’s 87th Annual International Conference on Assessment Administration held in Boston Massachusetts.

Ayesha Solomon, Alachua County Property Appraiser, has been a member of IAAO since 2019. Solomon has continually served in this position since then and maintained the prestigious standards of her predecessor, Ed Crapo who guided the county to be the first-ever recipient of the IAAO Certificate of Excellence in 2004.

“It is truly an honor for our office to be a recipient of this award,” Solomon said. “I am proud to lead such a hard-working, dedicated team that continues to use best practices in assessments.”

IAAO was founded in 1934 and sets the standards for best practices in mass appraisal and property tax administration. IAAO currently serves more than 8,000 members globally with the world’s premiere assessment library, professional designations, publications and educational resources.

“Our vision is to be recognized as the gold standard of excellence in property valuation and administration through innovation, collaboration, quality service, and community outreach,” Solomon said.

IAAO’s award program recognizes exceptional achievements in various areas of the valuation profession. Awards are given in over 20 categories ranging from jurisdictional public information programs to research on property appraisal and tax policy.

About the Alachua County Property Appraiser’s Office

The Alachua County Property Appraiser’s Office ensures that all taxable property in the county is assessed equitably and at its fair market value in accordance with Florida statutes. The Property Appraiser’s Office has two locations: 515 N. Main Street in Gainesville and 15010 NW 142nd Terrace in Alachua. For more information visit https://www.acpafl.org

Alachua County Property Appraiser’s Office Introduces New Software for Homestead Exemption Monitoring

The Alachua County Property Appraiser’s Office is excited to introduce TrueRoll, a software used for monitoring homestead exemption, to its internal processes on October 1, 2022.

This software will be used to detect incorrect filings and fraudulent activity. It consists of an extensive verifying process for both exemptions that have already been granted as well as new applications. This software extracts over 1,000 data sources and produces a prioritized list of potentially unqualified exemptions that will be reviewed by our staff in real-time.

In addition to capturing the unqualified exemptions, this software will also identify properties that qualify for the exemption but do not have it. This way those who are entitled can be contacted about this benefit.

Exemptions that are filed at multiple properties or secondary locations are illegal and a form of fraud. “This software will assist us in identifying those individuals whose circumstances changed after they applied, or who changed their documentation,” Property Appraiser, Ayesha Solomon said. “Therefore, they legally changed their primary residence after they were approved, making the exemption no longer valid.”

A common example of these improper exemptions is when residents claim the exemption on a vacation home or rental property. This office has discovered cases where property owners claim this exemption on homes in two different states or even on two homes in Alachua County at the same time.

“We currently have a strict process for verifying legal residence qualifications that involves checking applications against residents’ tax returns, driver’s licenses, voter registrations, and vehicle registrations for validation purposes,” Solomon said.

In 2022, the Alachua County Property Appraiser’s Office granted nearly 4,000 homestead exemptions to qualifying residents. Taxpayers who claim a homestead exemption for their primary residence will receive a reduced tax bill.

About the Alachua County Property Appraiser’s Office

The Alachua County Property Appraiser’s Office ensures that all taxable property in the county is assessed equitably and at its fair market value in accordance with Florida statutes. The Property Appraiser’s Office has two locations: 515 N. Main Street in Gainesville and 15010 NW 142nd Terrace in Alachua. For more information visit https://www.acpafl.org

Alachua County Hawthorne Probate and Estate Planning Summit

GAINESVILLE, Fla –

About 1 in 20 residential properties in the city of Hawthorne are at risk of entering the costly and lengthy probate legal process.

The Alachua County Property Appraiser’s Office will be hosting its second Probate and Estate Planning Summit on August 18, 2022, at 6 p.m. This will be located at Hawthorne Middle/High School at 21403 SE 69th Ave, Hawthorne, FL 32640.

This event will feature an interactive panel discussion led by representatives from the Alachua County Clerk of Court, the Alachua County Tax Collector, Alachua County Commissioner Anna Prizzia, the University of Florida Levin College of Law and Three Rivers Legal Services Inc. Each panelist will discuss how their respective offices are directly impacted by the extensive probate process and how many individuals can opt to create estate plans that are aimed at allowing assets to pass outside of the probate process.

“In February 2022, we launched our initial summit to help families affected by the financial burden of the probate and estate planning process,” Property Appraiser, Ayesha Solomon said. “This momentum spurred us to share approaches and evidence-based practices that have shown promise for reducing the 6.5 percent of properties in the area that are currently at risk of entering the probate process.”

The Alachua County Property Appraiser’s Office formulated this initiative through a dual data-driven approach that identified all the parcels that are classified as heirs’ property throughout the county as well as parcels with only one remaining owner listed on the property suggesting a lack of proper estate planning. After successfully analyzing both data sets, two heat maps were created to showcase the “hot spot” areas in the county that are affected the most by these issues.

Wendy Sapp, Hawthorne City Manager, said “we hope that our community will benefit from this initiative and be able to walk away with information and resources that will help them navigate through probate and estate planning.”

The Alachua County Property Appraiser’s Office will be practicing social distancing measures to minimize the risk of COVID-19 to guests.

About the Alachua County Property Appraiser’s Office

The Alachua County Property Appraiser’s Office ensures that all taxable property in the county is assessed equitably and at its fair market value in accordance with Florida statutes. The Property Appraiser’s Office has two locations: 515 N. Main Street in Gainesville and 15010 NW 142nd Terrace in Alachua. For more information visit https://www.acpafl.org

Alachua County Property Appraiser’s Office Introduces New Program to Avoid Risk of Property Fraud

GAINESVILLE, Fla– The Alachua County Property Appraiser’s Office is excited to introduce a free monitoring service to help residents protect their property.

Our office has developed a new software called Property Watch. Property owners can sign up for this service through our website. All owners who register must provide the following information: a name, a date of birth, a Florida Driver’s License/ID number, a property parcel number, and an active email address. For those who are not aware of their parcel number, this information can also be found on our website.

After this registration process, owners can expect this service to continuously monitor their property. The areas that will be monitored for changes include the owner’s name, the mailing address, any change in exemption or agricultural classification status, and splits and combines to parcels.

An automated email will be generated to owners only if changes are made in these areas when processed by our office. If the changes have been made by the owner, no additional action is required. If the owner did not initiate these changes they should contact our office immediately to verify why these changes have taken place.

“This service is intended to empower the taxpayer by providing them the means to monitor the status of their property,” Ayesha Solomon said. “This ultimately protects against fraudulent transactions while also alleviating stress on property owners.”

An owner will continue to receive notifications until they unsubscribe or if they have sold the property they signed up to monitor.

This service is not a substitute for a title search. Ownership records are changed based on deeds recorded with the Alachua County Records Division. Although our office has no legal authority to determine if a deed is fraudulent, this issue is becoming more common and our office is proud to provide this service to reduce the risk to taxpayers. If an owner believes fraudulent activity has taken place, they should notify local law enforcement.

Sign up for free here: Property Watch

Florida Association of Property Appraisers Outlines the Florida Legislature Annual Revision of Proposed Bills

GAINESVILLE, Fla– Florida residents who qualify as widowed and/or disabled can now expect to receive a tax exemption increase from $500 to $5,000 off of their property assessed value.

The Florida Legislature passed these bills on March 15, 2022, and it is projected to go into effect for the 2023 tax year.

This is the first time the widowed tax deduction has increased since its effective year in 1968. Both the widow and disability are considered to be minimal requirement exemptions for Florida property owners who have maintained residency in the state. Therefore, any Florida resident who is widowed or disabled as of January 1, 2023, can apply to receive these benefits.

“Previously the $500 exemption saved residents about $10 in actual tax savings,” Alachua County Property Appraiser and FAPA Sergeant at Arms, Ayesha Solomon said. “With this new increase, taxpayers who qualify for this exemption will benefit from approximately $100 in annual property tax savings.”

“I was informed that the ability to move several legislative bills in a year is a little unorthodox. This makes an ordinary day at work extraordinary,” she said.

In addition to recent increases in residential savings, agricultural operators also saw a boost this year with the passage of language promoting agritourism as an additional stream of income and benefits to agriculture operations.

Cregg Dalton, Citrus County Property Appraiser, and FAPA President-Elect said, “I am proud of our members, who worked diligently with legislators and their staff, to ensure the language of these bills will best benefit our constituents.”

Currently, the Critical Public Services Workforce bill is a pending amendment to the State Constitution for all levies other than the school district. The Legislature may provide an additional homestead exemption on the assessed valuation of greater than $100,000 and up to $150,000 for classroom teachers, law enforcement officers, correctional officers, firefighters, emergency medical technicians, paramedics, child welfare services professionals, active-duty members of the United States Armed Forces, and members of the Florida National Guard.

This amendment will be placed on the November ballot if passed by voters.

Alachua County Probate and Estate Planning Summit

GAINESVILLE, Fla. — Alachua County residents have $261 million of property value at risk of entering a costly and lengthy probate legal process.

The Alachua County Property Appraiser’s Office is proud to host its first Probate and Estate Planning Summit on February 24, 2022, at 6 p.m. located at Mount Carmel Baptist Church T.A. Wright Family Life Center at 2505 NE Eighth Ave.

Our goal is to bring community awareness to the probate process while introducing programs and financial resources that are currently available to help heirs who have to go through the costly legal process of resolving title issues.

This inaugural event will feature an interactive panel discussion led by representatives from the City of Gainesville Community Reinvestment Area, the City of Gainesville Commissioner Harvey Ward, the Alachua County Clerk of Court, the Alachua County Tax Collector, Alachua County Commissioner Anna Prizzia, and Three Rivers Legal Services Inc. Each panelist will discuss how their respective offices are directly impacted by the extensive probate process and how many individuals can opt to create estate plans that are aimed at allowing assets to pass outside of the probate process.

“This will be the first time all of our local government offices will work together in figuring out a way to help these families,” Property Appraiser, Ayesha Solomon said. “Our hope is that this summit will allow us to continue partnering with trusted community-based organizations in order to alleviate the financial burden of the probate process while educating our community on the importance of estate planning.”

The Alachua County Property Appraiser’s Office formulated this initiative through a dual data-driven approach that identified all the parcels that are classified as heirs’ property throughout the county as well as parcels with only one remaining owner listed on the property suggesting a lack of proper estate planning. After successfully analyzing both data sets, two heat maps were created to showcase the “hot spot” areas in the county that are affected the most by these issues.

“To hear that in our geographic location, there is a significant number of properties that have been impacted by probate or estate planning issues, and then to learn that number is over 300 properties just in our vicinity, it is great to hear that someone is working to improve the transfer of property and assets that will work to increase creating generational wealth,” Senior Pastor of Mount Carmel Baptist Church, Destin Williams said.

The Alachua County Property Appraiser’s Office will be practicing social distancing measures to minimize the risk of COVID-19 to guests.

About the Alachua County Property Appraiser’s Office

The Alachua County Property Appraiser’s Office ensures that all taxable property in the county is assessed equitably and at its fair market value in accordance with Florida statutes. The Property Appraiser’s Office has two locations: 515 N. Main Street in Gainesville and 15010 NW 142nd Terrace in Alachua. For more information visit https://www.acpafl.org.

Seniors Now Eligible for Easy-to-renew Property Tax Exemption

GAINESVILLE, Florida — Seniors who dislike filling out forms and turning in paperwork can take heart.

If they are low-income homeowners age 65 and older they may no longer need to submit a household income statement every year to qualify for a senior tax exemption. The change to the state’s statute on property tax exemptions was passed by Florida Legislature and goes into effect July 1 for 2022 renewals.

“That’s good to know because unless I come upon a big inheritance, I don’t foresee my income going up,” said Gainesville retiree Mary Anne Flesner, who recently visited the Alachua County Property Appraiser’s Office to submit her income statement.

Each year, the Property Appraiser’s Office provides tax exemptions on the homesteads of thousands of permanent residents in Alachua County. In addition, some of those 65 and older qualify for a special senior exemption if their total household adjusted gross income is less than $31,100 for 2021.

What’s changed

Now seniors don’t need to submit the required sworn statement of their household income every year after their initial submission and application has been approved — provided their income hasn’t increased above the threshold. The Florida Department of Revenue adjusts the income limitation every year based on the consumer price index.

“We hope the easy-to-renew option will lessen the burden on seniors who have had to submit their income statement every year,” Alachua County Property Appraiser Ayesha Solomon said.

There’s another benefit: A savings in staff time and administrative costs, which boosts the Property Appraiser Office’s mission of being a good steward of taxpayer dollars.

Learn more about senior exemptions

Based on current millage rates assessed by taxing authorities, those who qualify for senior exemptions can save up to $400 on annual taxes owed Alachua County and certain municipalities, said Dan Marvel, director of Customer Service and Exemptions. These exemptions apply only to the millage rates levied by the county and municipalities that have approved the exemption: the cities of Gainesville, High Springs, Micanopy and Alachua. They do not apply to the millage rates set by the Alachua County Public Schools.

“We encourage eligible seniors to take advantage of these significant property tax exemptions,” Solomon said.

Additionally, the state statute allows a “super seniors” exemption for those 65 and older who qualify for the first senior exemption provided they meet other requirements: live for at least 25 years in their home and its value is less than $250,000. These “super seniors” in Alachua County are entitled to an exemption only on the millage rates levied by the county and the city of Micanopy. It hasn’t been adopted by other municipalities in the county. And they also don’t apply to millage rates set by Alachua County Public Schools.

About the Alachua County Property Appraiser’s Office

The Alachua County Property Appraiser’s Office ensures that all taxable property in the county is assessed equitably and at its fair market value in accordance with Florida statues. The Property Appraiser’s Office has two locations: 515 N. Main Street in Gainesville and 15010 NW 142nd Terrace in Alachua. For more information visit https://www.acpafl.org.

The Property Appraiser’s Northwest Location in the City of Alachua

The new Alachua office is in the Swick House at 15100 NW 142nd Terrace.

Lets hit the ground running. Starting Monday, February 22, 2021, the Alachua County Property Appraiser’s Office is expanding its operations to the Northwest side of the county. By partnering with the City of Alachua, the Property Appraiser’s services are more accessible for the residents who may find this location more convenient.

This satellite office will have all the functions and capabilities as the main office. Assistance with filing for exemption services being offered includes: Agriculture Classification, Blind, Disabled, Homestead, Over-65 Low Income Senior, Veteran Disability/Discounts and Widow-Widower. Other departmental services offered will include Customer Service and Exemptions, Tangible, Residential, Commercial, GIS and Title.

The new Northwest office hours are Monday through Thursday from 9:00am to 4:00pm, excluding holidays, and will be located at the City’s Swick House at 15010 NW 142 Terrace Alachua, FL 32615. Hours of operation may be adjusted based on demand and/or seasonality.

We are extremely cognizant of the social disruption caused by the pandemic. For this reason, both offices are operating by appointment only. Appointments can be scheduled from our website at www.acpafl.org For more information about the Property Appraiser’s services, residents and businesses can contact the Alachua County Property Appraiser’s Office by calling 352-374-5230 or email acpa@acpafl.org.

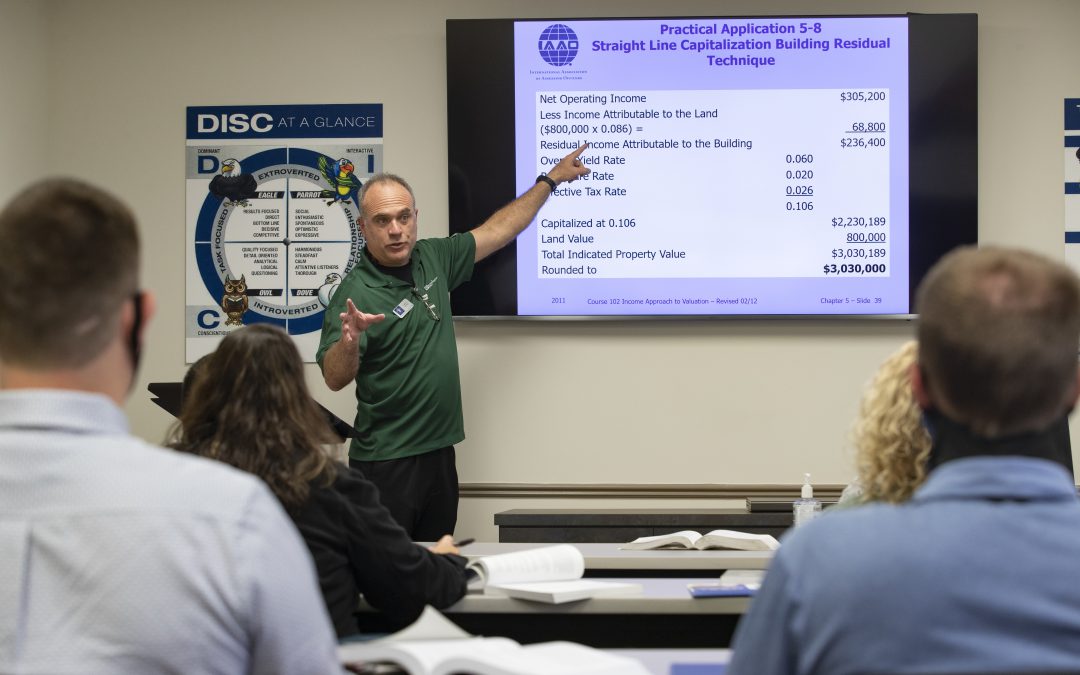

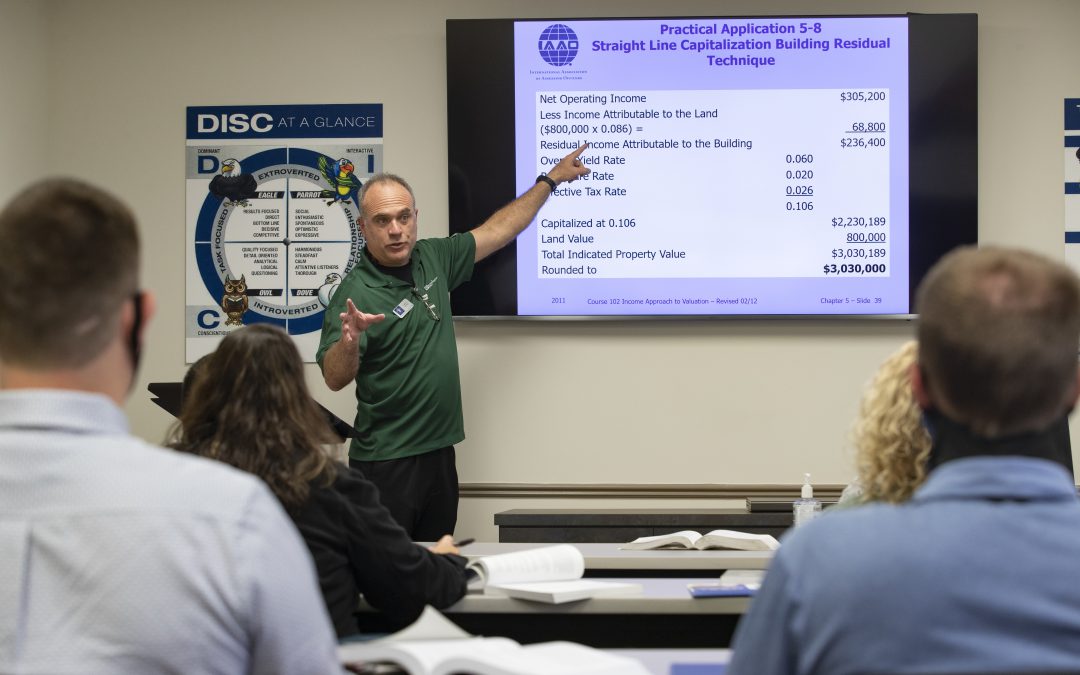

Property Appraiser staff member gains national certification to teach worldwide

Recently, one of the Alachua County Property Appraiser staff, Lance Briner, CFE, became certified as an International Association of Assessing Officers (IAAO) “Live-online educator”. This designation qualifies that he can now teach students both nationally and internationally, via online training.

Earning this certification comes after months of studying, planning and teaching live classes and lectures. He is one of approximately 150 instructors, world wide, who can conduct online training courses for the IAAO. He is also one of only two staff members in our office’s history to be able to instruct students from around the world and the only staff member to be able to instruct live-online.

This designation will now enable Mr. Briner to teach classes in mass appraisal practices and procedures, appraisal theory and much more. Obtaining this designation enables our office to continue moving toward the most advanced, educated, and cutting edge agency in appraisal assessments in the United States and the world.

The IAAO is a global community that promotes excellence in property appraisal, assessment administration and property tax policy through professional development, research and standards.

Join us in congratulating Lance Briner, CFE, in this significant accomplishment.