What is a Denial?

What is a Denial?

A “denial” refers to the process by which the Property Appraiser’s Office denies an applicant’s applications for certain tax exemptions, such as homestead, veterans, or senior-related benefits, as well as agricultural classifications.

When a person has been notified of an exemption denial by registered mail, they have until 25 days after the mailing of their TRIM notice to file an appeal with the Value Adjustment Board (VAB).

Applicants whose exemptions have been properly denied must file their appeals within the filing period. If a properly denied applicant misses their VAB filing deadline, their only recourse is to file suit in the circuit court.

A petitioner is given an appointment for a VAB hearing before a Special Magistrate who is an attorney not affiliated with either the Board of County Commissioners or the Property Appraiser. This person is an independent hearing officer hired to hear appeals of exemption denials. At the hearings of the VAB, the petitioner or their representative must appear in the manner designated on their appeal either by person or electronically at the appointed time and place, and present evidence that demonstrates that they are entitled to the denied exemption.

An exemption specialist from the Property Appraiser’s office will also be present to present the documentation and statutory references upon which the denial was based. The Special Magistrate will consider all evidence presented and make a ruling to either grant or deny the exemption. The decision of the VAB is final unless the petitioner files suit in the circuit court within 15 days of the ruling or the Property Appraiser files suit within the appropriate time frame.

If an exemption application is filed late, the petitioner must present evidence and documentation demonstrating extenuating circumstances beyond his or her control that precluded the applicant from filing by the March 1 deadline.

Rules of evidence for the VAB apply to petitions for exemption denials and for valuation issues. At least 10 calendar days before the petitioner’s scheduled hearing, they must provide a list, summary of, and copies of any evidence to be presented at the hearing. In turn, the Property Appraiser must provide the same information to the petitioner no later than 5 days after receiving the petitioner’s evidence. According to VAB procedures, any such evidence not submitted by the petitioner by these deadlines cannot be presented at the hearing. A petitioner has the right to reschedule a VAB petition once with good cause. The request must be sent to the VAB in writing.

Common Reasons for Receiving a Denial

Homestead Denials

The following items have not been updated to reflect the address on the initial submitted application:

- Driver’s License

- Vehicle Tags

- Voters Registration

Senior Exemptions Denials

- Applicant was not 65 years old as of January 1

- Total household adjusted gross income for all persons, regardless of ownership, exceeds the limitation

- Proof of total household adjusted gross income for all persons, regardless of ownership was not submitted

- Unable to verify with the Internal Revenue Service that the household adjusted gross income

Widow/Widower Exemptions Denials

- Applicant was not a widow/widower on January 1.

- Death certificate was not submitted for the widows/widowers exemption.

- The applicant was divorced, not an unmarried widow/widower, as required by the Florida Department of Revenue regulation.

Total and Permanent Disability Exemptions Denials

- Applicant did not submit a completed physician’s certification of permanent disability.

- Applicant did not submit a physician’s certification form DR-416

Service Connected Total and Permanent Disabled Veteran Exemptions Denials

- Applicant did not submit a letter from the Veteran’s Administration (VA) certifying a Service Connected Total and Permanent disability.

- Applicant does not have a Total and Permanent Service Connected disability.

- The application was not filed on required state form (DR 501)

Service Connected 10% or More Disabled Veteran Exemptions Denials

- Applicant did not submit a letter from the Veteran’s Administration (VA) certifying a Service Connected disability.

- No evidence that the ex-servicemember is service-connected disabled to a degree of 10% or more.

- The application was not filed on the required state form (DR 501).

Agricultural Classification Denial

- The property was not owned as of January 1st

- The farm is not operational as of January 1st

- Lacking documentation (Example: missing “Farm plan,” “Timber management plan,” “receipts,” etc…)

- The farm is for personal use or is a hobby farm instead of commercial use.

- During our office’s inspection, the land appeared to be NOT used. Sometimes, this is due to seasonality.

- For leased operations, the lease needs to be signed and dated as of January 1st or prior.

- Stocking rate is too low for the amount of acreage. (Example: Not enough trees, cows, chickens, etc, for the amount of acreage)

Helpful Steps to Reverse Your Denial

Simple Phone Call

Please call before you submit any documents—we might not need them and can verify over the phone: Please call (352) 374-5230 and request to speak with our Public Service and Exemptions or Agricultural Department.

Digital Submission of Documentation

If you have contacted our Public Service and Exemptions or Agricultural Department and have been advised to submit additional documentation as a means to reverse your denial, please select the appropriate button below to submit additional documentation.

Schedule an Appointment

If you have additional questions or require additional assistance, please schedule an appointment with the Public Service and Exemptions Department here: https://www.acpafl.org/make-appointment/

Walk-ins are also accepted

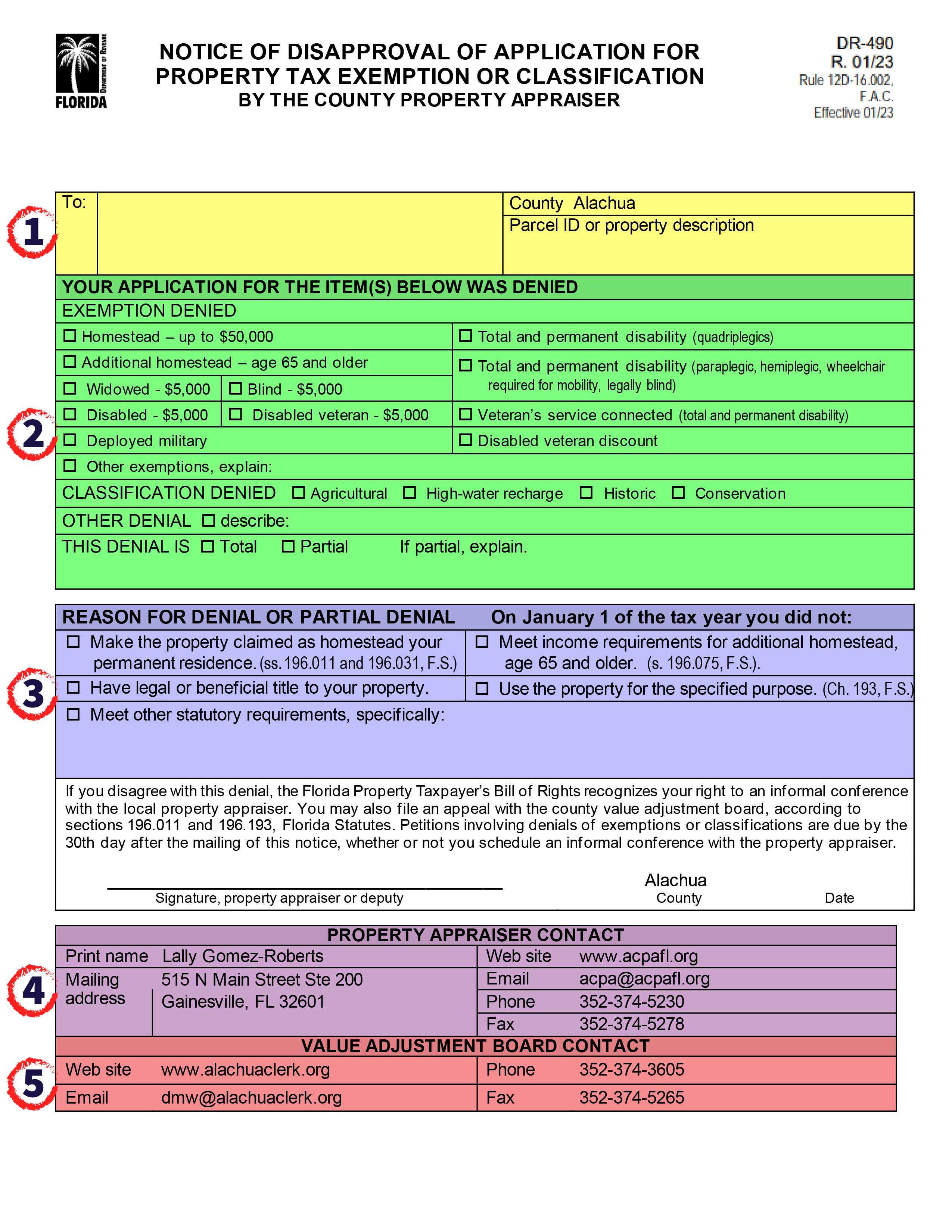

Denial Explanation and Breakdown

- Name and parcel ID (yellow) – This section lists the person that this denial is for and the Parcel ID that this denial is about.

- Which application is being denied (green) – This section will show which exemptions are being denied.

- Reason for denial or partial denial (blue) – This section will show you if the reason is one of the 4 main reasons we see for a denial or if there are other statutory requirements that are need to fulfilled specifically.

- Property Appraiser’s Office Contact (purple) – This section has our mailing address, contact email address, website address, and ACPA’s phone and fax numbers

- Value Adjustment Board Contact (red) – This section has the website, email, fax, and phone number for the Alachua County Clerk of Court.

*denial letter is not sent out color coded