What is Portability

Portability is the ability of homeowners to transfer their Save Our Homes (SOH) benefit when moving to a new primary residence within the state of Florida. This benefit limits how much a homestead property’s assessed value can increase annually, helping homeowners reduce their property taxes.

Save Our Homes (SOH) and Portability Background Info

SAVE OUR HOMES

In 1992 Florida voters approved Constitutional Amendment 10, meant to shield homeowners from runaway increases in their property taxes as a result of the booming real estate prices. This is also known as Save Our Homes.

TRANSFER OF HOMESTEAD ASSESSMENT DIFFERENCE A/K/A PORTABILITY(FORM DR-501T)

Since 1995, when a property begins receiving a Homestead Exemption the assessed value on the tax roll cannot increase more than 3% or the CPI, whichever less. When market values increase at a greater rate, this limitation on the assessed value creates a difference in the assessed and market values of a property known as the Homestead Assessment Difference. This “Cap” on the assessed value saves property owners from large increases in property taxes on their Homesteaded property.

While this Cap benefit saved property owners thousands of dollars in taxes on their Homesteaded property, they lost this benefit if they bought a new home. Through the introduction of Amendment 1 on January 29, 2008, Florida voters amended the State constitution to provide for transfer of a Homestead Assessment Difference from one property to another. This benefit first became available in 2008. It may be transferred to any property in Florida and is commonly referred to as “PORTABILITY.”

1-2-3 of Appling for Portability

Establish Homestead

You must establish the homestead exemption on the new property within 3 assessment years (3 January 1st) after abandoning the homestead exemption on the previous property.

What if you forgot to file?

If you failed to apply for portability in the first year of your new homestead, if you would have otherwise qualified, you may file in subsequent years. Waiting to apply will NOT give you a greater Portability amount as the Portability is calculated by 1st year your are qualified for your new homestead.

Assessment Difference Applied

Assessment difference from the year in which the homestead exemption was abandoned will be applied to the assessed value of the new homesteaded property in the year that the portability is first approved. You can learn more about the calculations below!

Portability Calculation

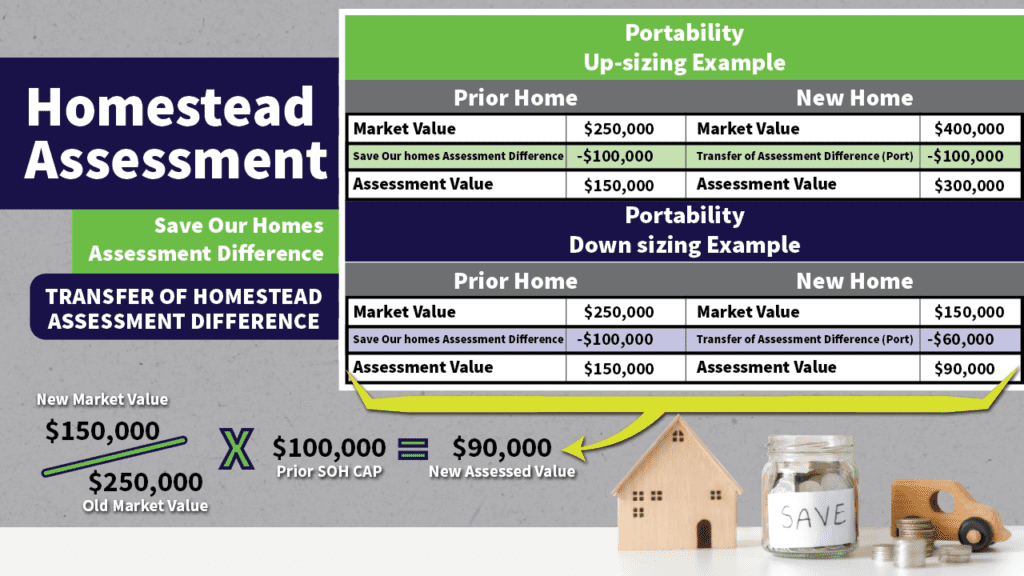

Florida’s homestead portability calculation determines how much of your Save Our Homes (SOH) benefit you can transfer when moving to a new primary residence.

Calculation Steps

Determine Prior Home’s Save Our Homes (SOH) Benefit:

- The SOH benefit is the difference between the market value and the assessed value of your previous home.

- Example: If your prior home had a market value of $250,000 and an assessed value of $150,000, your SOH benefit is $100,000.

Apply the Benefit to the New Home:

- If your new home has a higher market value, you can transfer the full SOH benefit.

- If your new home has a lower market value, the benefit is prorated based on the percentage reduction in market value

Calculate New Assessed Value:

- The new home’s assessed value is determined by subtracting the transferred SOH benefit from the new home’s market value.

Apply Homestead Exemption:

-

Florida offers a $50,000 homestead exemption, which further reduces taxable value.

-

Example: If your new assessed value is $160,000, after applying the $50,000 exemption, your taxable value would be $110,000.

Downsizing Example:

(See image above)

Old Home Market Value: $250,000

SOH Benefit: $100,000

New Home Market Value: $150,000

First, we need to determine the market value of your new home, which is $150,000, a figure that is less than the value of your previous house. Therefore, your portability amount needs to be calculated. This is done by taking your SOH benefit ($100,000) and multiplying it by the division of your new home value ($150,000) by your old home value ($250,000)

$100,000 × (150,000 ÷ 250,000) = $60,000

This will give you your Transfer of Assessment Difference or Portability Amount: $60,000

We will then take the new market value ($150,000) and subtract your portability amount ($60,000).

This will give you a new assessed value of $90,000.

Remember that once Portability is figured out and you have your new assessed value, you will also receive your SOH (up to $50,000*) to reduce your taxable value further. For this example, after Portability and SOH, this taxable value would be $40,000

*The SOH amount may increase every year due to Amendment 6

For more information about Save Our Homes/Portability, please visit:

https://floridarevenue.com/property/Documents/pt112.pdf