Exemption Guide

Click on a question to find the answer.

Available Property Tax Exemptions and How to Qualify for Them

What is homestead exemption?

Under the Florida Constitution, qualified residents may receive an exemption that reduces the taxable value of their property up to $50,000.

Who qualifies for homestead exemption?

Florida residents who have legal or equitable title to property, occupy the home, and have the intention of making the property their permanent residence as of January 1 are eligible for homestead exemption.

Do I have to be a U. S. citizen?

Yes, except permanent resident aliens and residents permanently residing in the United States under color of law (PRUCOL).

When do I apply?

You are urged to file as soon as possible once you own and occupy the residence. First time applicants must file before the deadline of March 1 for the tax year in which they wish to qualify.

What if I miss the deadline?

Missing the March 1 filing deadline waives your right to the privilege of homestead exemption until the following year. However, if you missed the deadline due to “extenuating circumstances”, you should contact our office for further information.

Do I need to apply for homestead exemption every year?

If you received a homestead exemption last year and still own and occupy that residence with the intention of making it your permanent home, your exemption application will be renewed automatically. A receipt will be mailed to you in early January. It is your responsibility to notify the Property appraiser if your qualification for the homestead exemption has changed.

Can homestead exemption be transferred?

No. You must make a new application every time you establish a new residence. Title and residency as of January 1 determine your qualification for homestead exemption. The exemption on your property when you purchased it is not yours and is not transferable to you.

Can I get an exemption if I reside in a mobile home?

Yes. If you have legal or beneficial title to the land you may qualify. Please bring in the title(s) or registration(s) of the mobile home. If you own both the land and mobile home, the mobile home must be declared real property by purchasing a RP decal. If you own the land but not the mobile home, the mobile home will not be assessed to the property, and a yearly decal must be purchased.

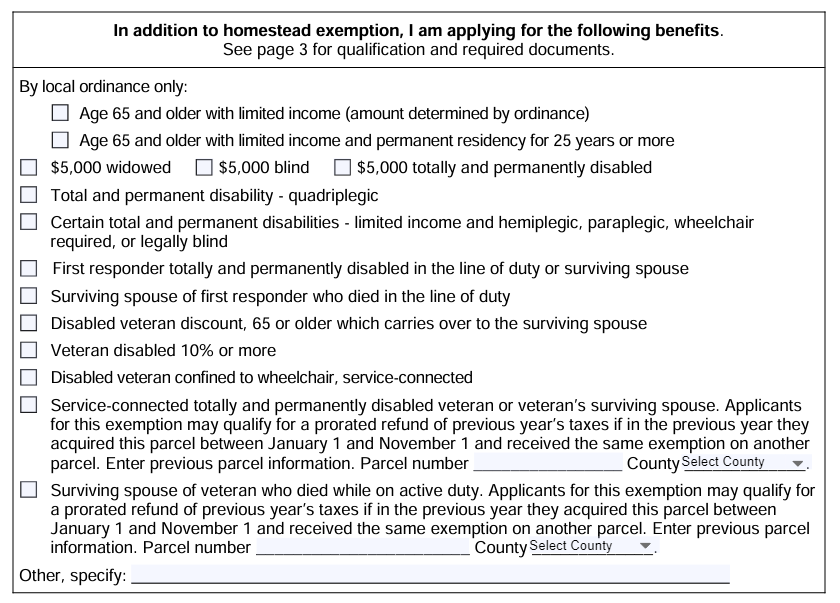

** What other exemptions are available? **

If you have questions regarding the available exemptions or how to apply for them, please contact our office.

** Additional exemption information available at the Florida Department of Revenue’s website: Florida Department of Revenue – Exemptions Available in Florida **

Important Dates to Remember

January 1 – The status and condition of your property on January 1 determine the property’s value for the tax year. Also, January 1 is the date that determines residency or ownership requirements to qualify for exemptions.

March 1 – Filing deadline for all exemption requests including homestead and all classified use, including agricultural classification.

April 1 – Deadline for filing tangible personal property tax return.

Mid August – Notice of Proposed Property Taxes or Truth in Millage, or TRIM, notices are mailed to property owners. This begins the appeal process and contains notification of deadlines.

November 1 – Tax bills are mailed.