TRIM Notice

What is a TRIM Notice?

The 1980 Florida Legislature’s Truth in Millage Act was designed to inform taxpayers which governmental agencies are responsible for the property taxes levied. The Notice of Proposed Tax forms, also known as Truth in Millage (TRIM) notices, are prepared and mailed each year by the Property Appraiser on behalf of the taxing authorities pursuant to Florida law. Although the TRIM notice is not a tax bill, it is intended to notify property owners of possible changes that may appear on the November tax bill. For more information regarding the history and facts about TRIM notices, click here.

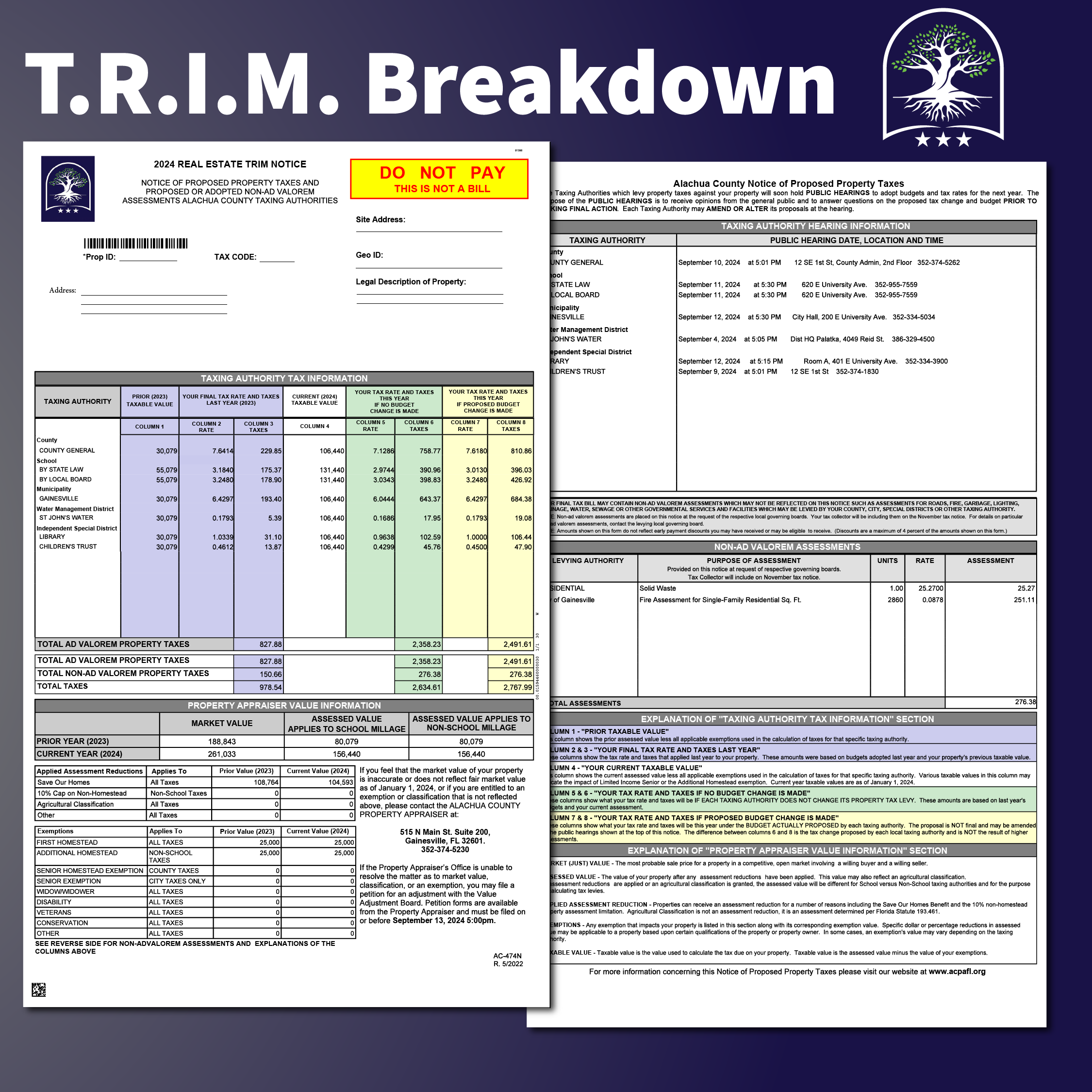

TRIM Notice Breakdown

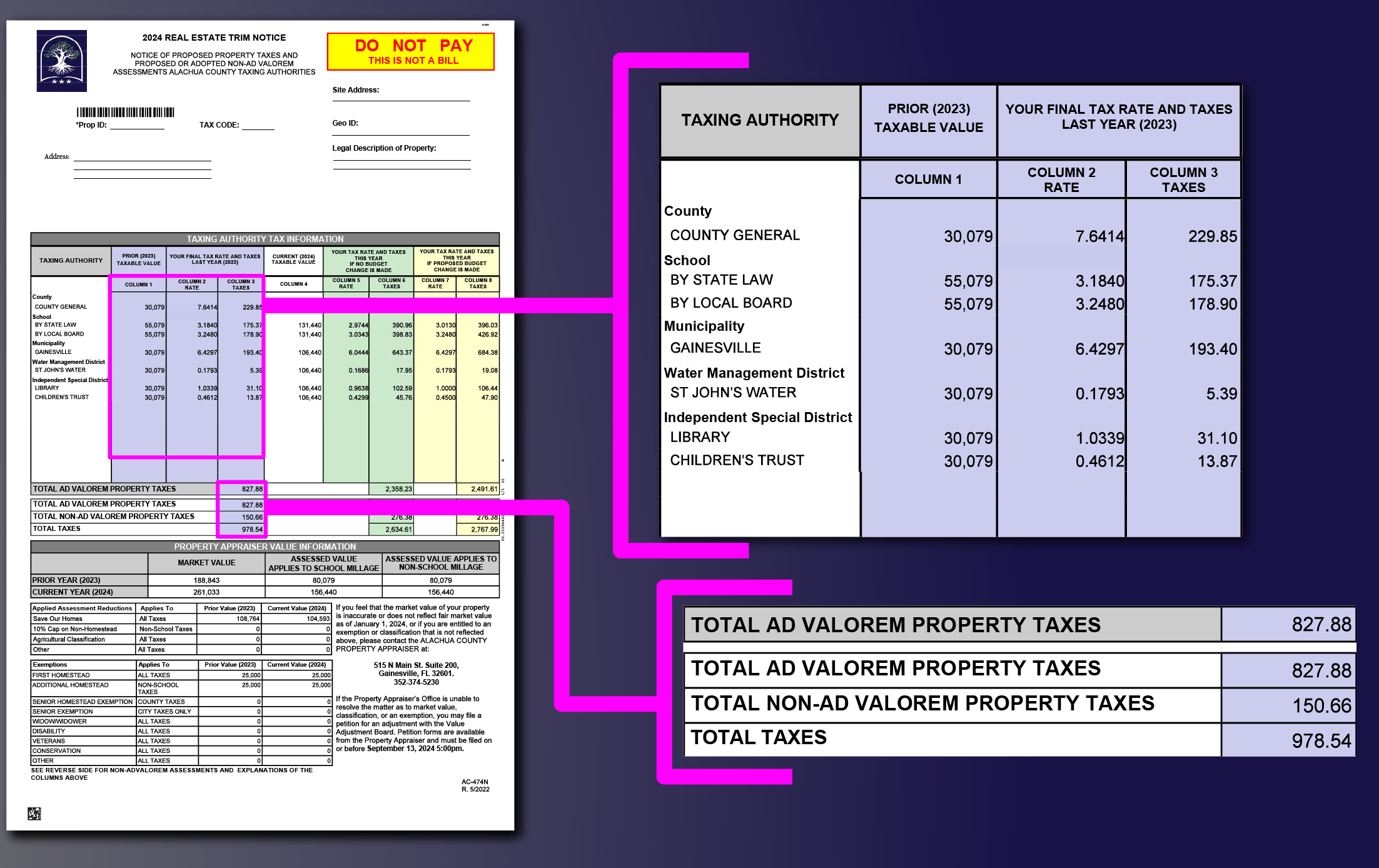

Each row is broken out into each taxing authority both Ad Valorem and Non-Ad Valorem

Column 1: shows the prior year’s taxable value.

Column 2: shows the final tax rate for the prior years property tax based on the prior years budgets

Column 3: shows the final tax amount for the prior year.

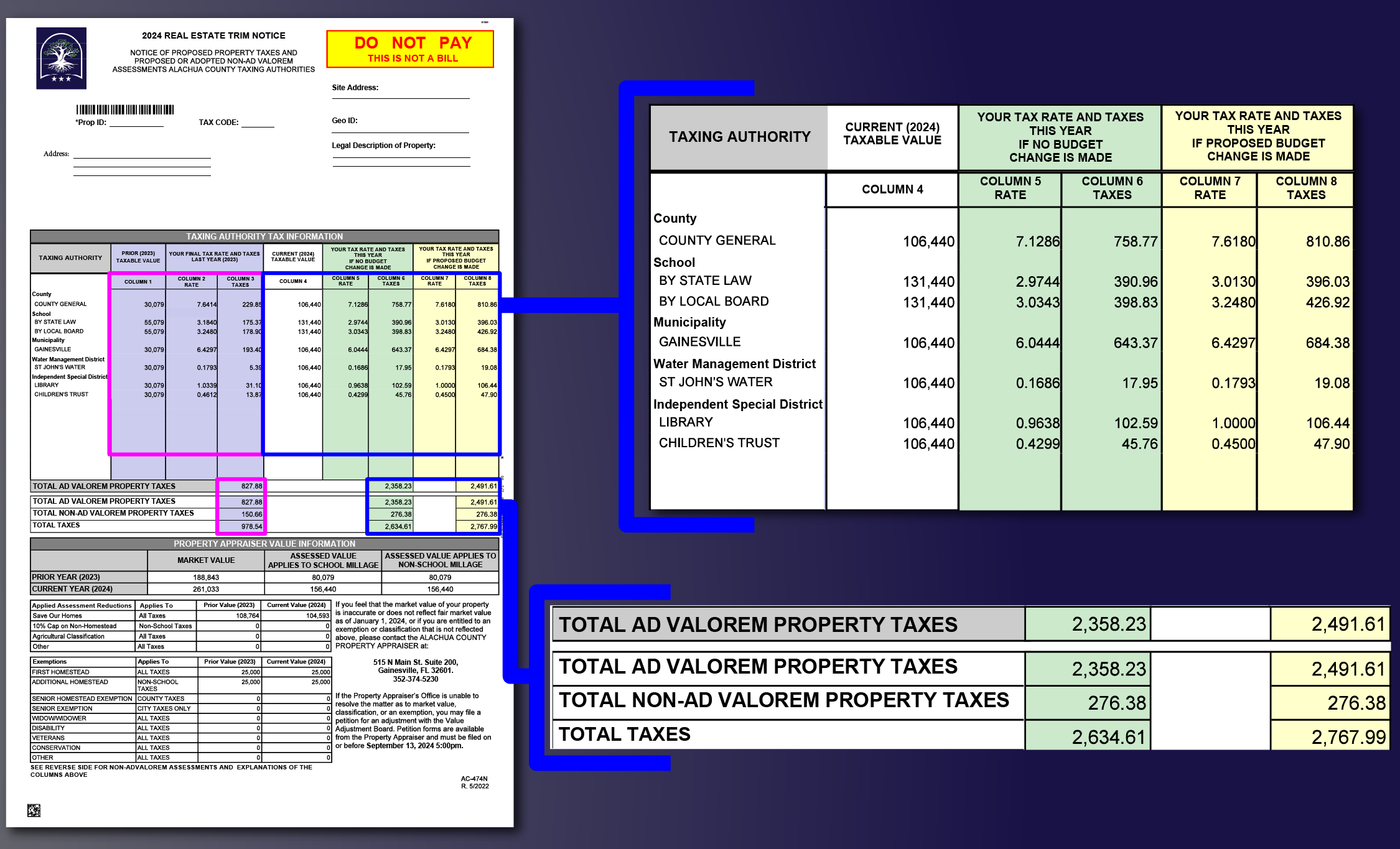

Each row is broken out into each taxing authority, both Ad Valorem and Non-Ad Valorem.

Column 4: shows the current year’s taxable value.

Columns 5 & 6: shows the tax rate and tax amount for the current year if no budget changes are made.

Columns 7 & 8: shows the tax rate and tax amount for the current year for the proposed budget change is made.

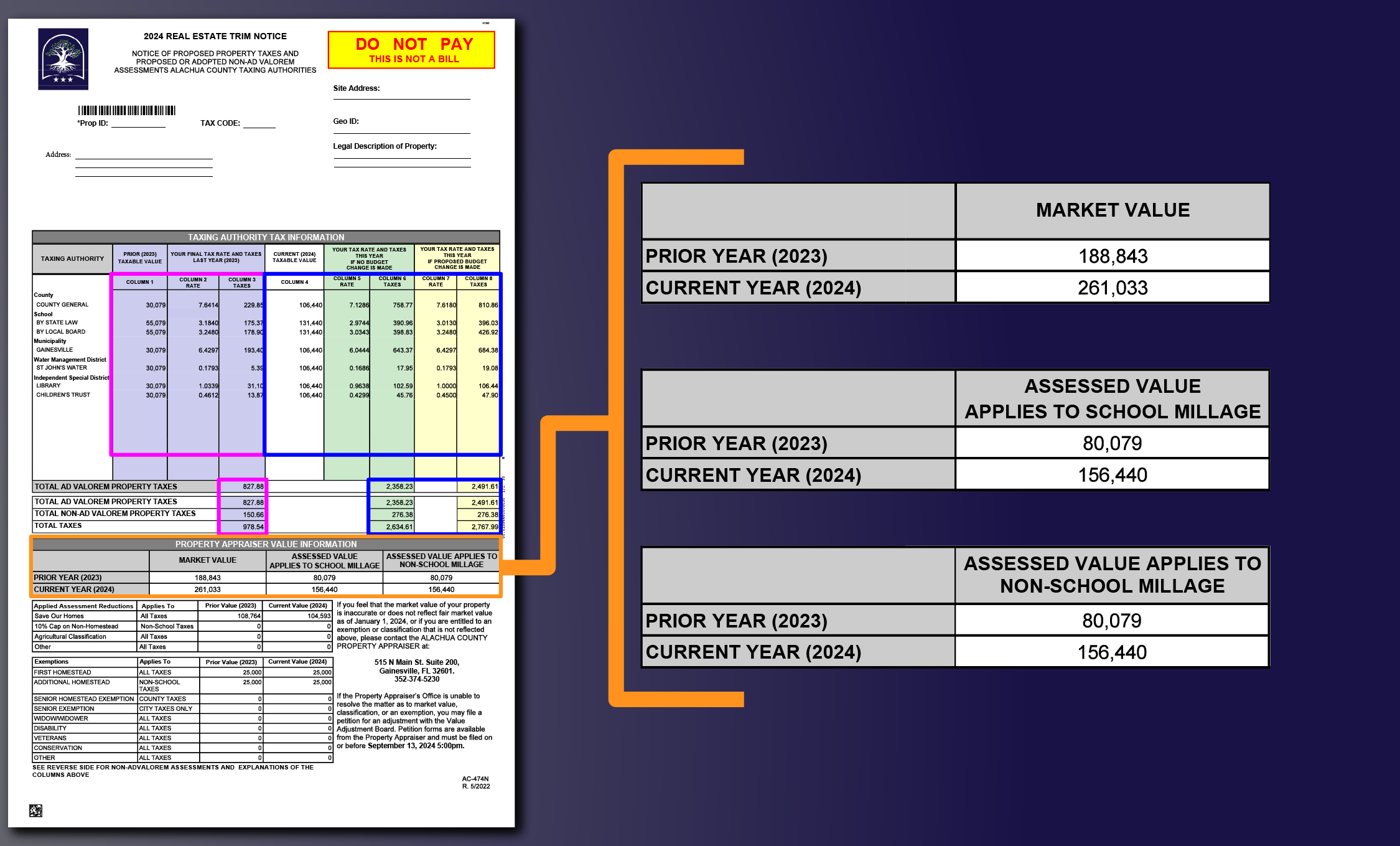

Each row is broken out into each PRIOR year and CURRENT year

Market Value Column – the market value of your property

Assessed Value applies to school millage – shows the value that school millage is applied (non-homesteaded properties will reflect the market value)

Assessed Value applies to Non-school millage – shows the value that non-school millage is applied (“Save our Homes” assessment cap amount listed here) (Max 3% increase per year for homesteaded and 10% for non-homesteaded)

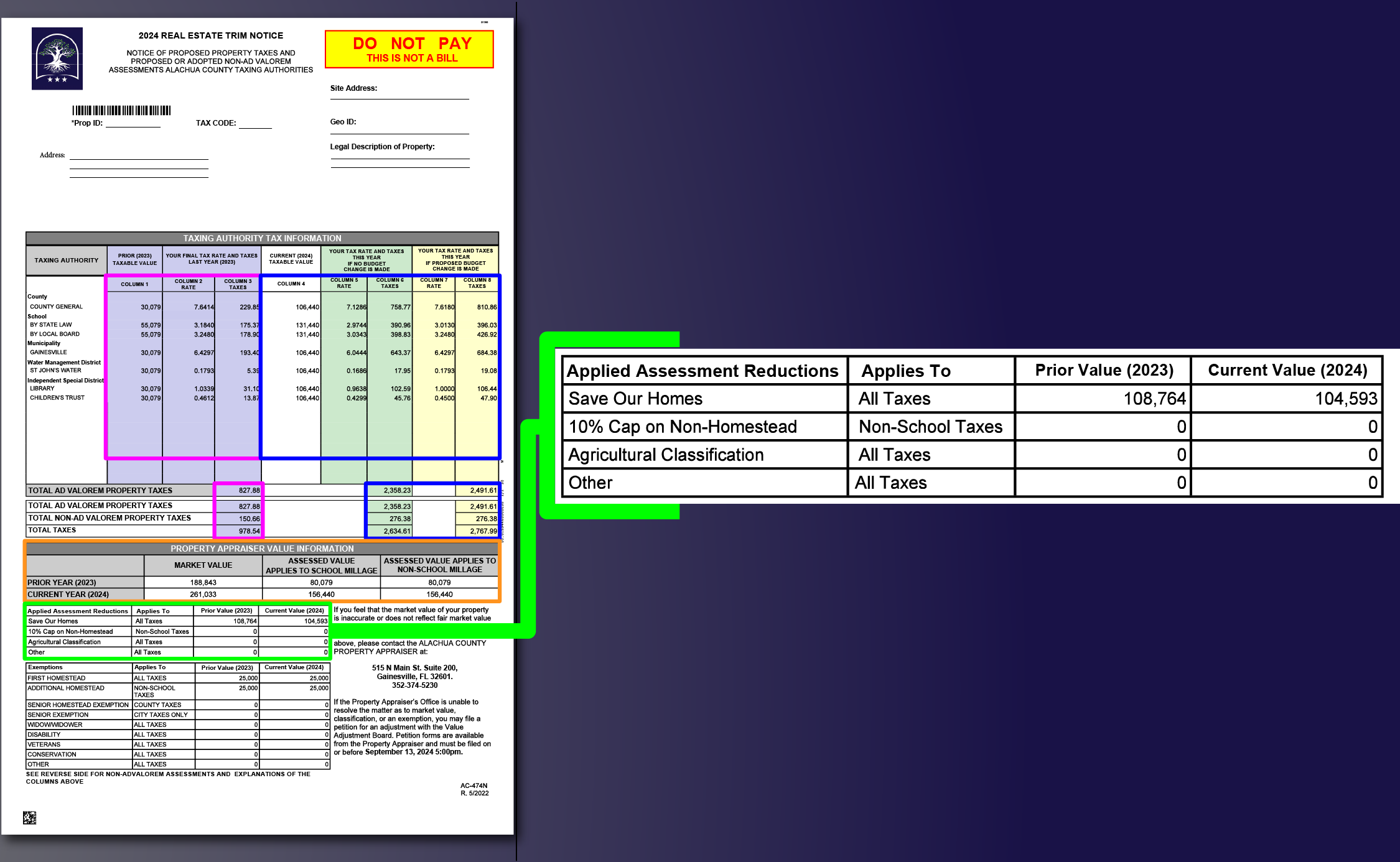

Each row is broken out into the different Reductions that are applied to the parcel’s Assessment Value – (Parcels can be broken in to multiple categories. Example: a homesteaded house can be on a parcel that also has agricultural classified land reduction. This will show values in multiple rows.)

Prior Value – Shows the prior year’s value as it pertains to the corresponding row.

Current Value – Shows the current year’s value as it pertains to the corresponding row.

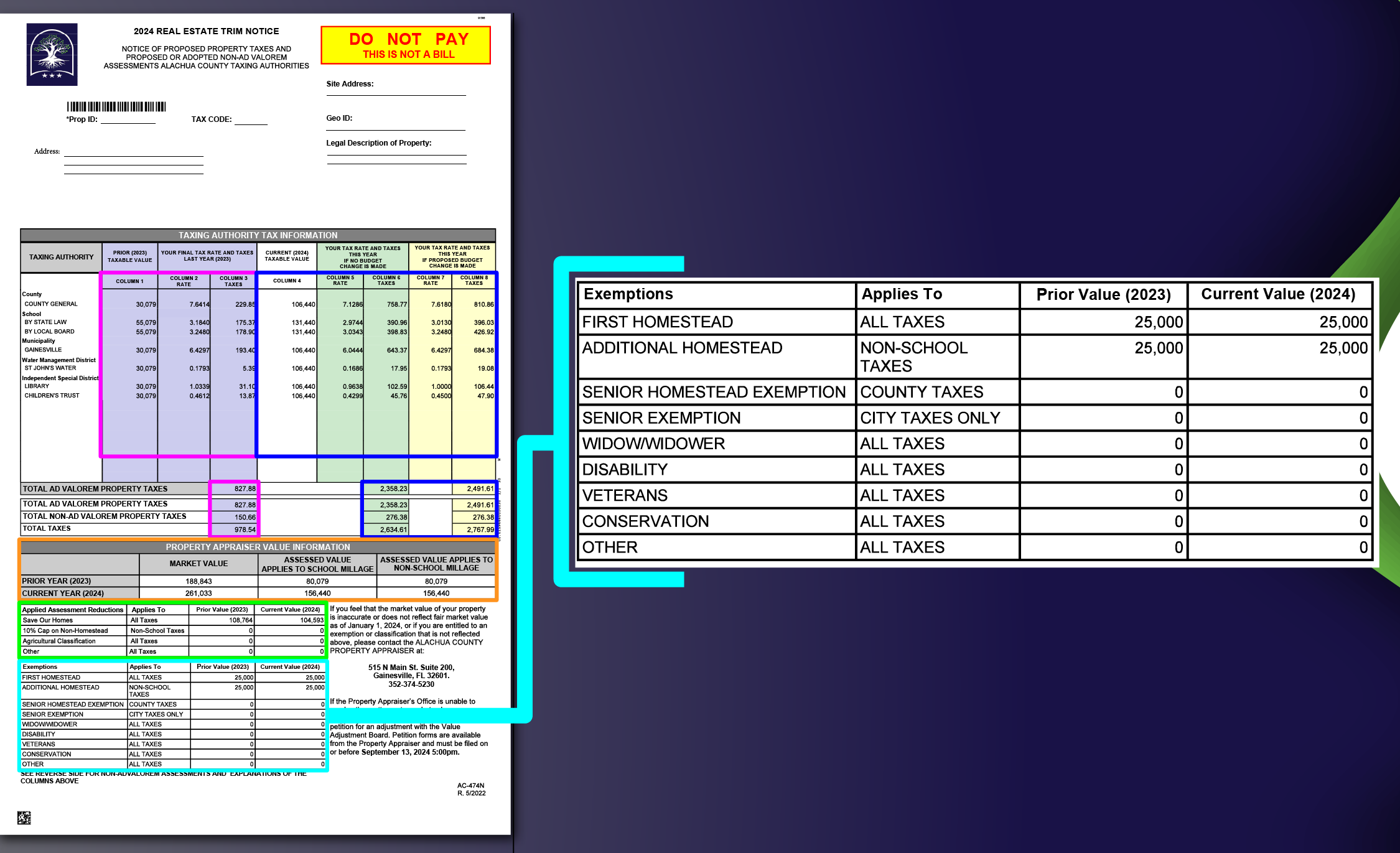

Each row is broken out into the different Exemptions that are available

Prior Value – Shows the prior year’s exemption amount as it pertains to the corresponding row.

Current Value – Shows the current year’s exemption amount as it pertains to the corresponding row.

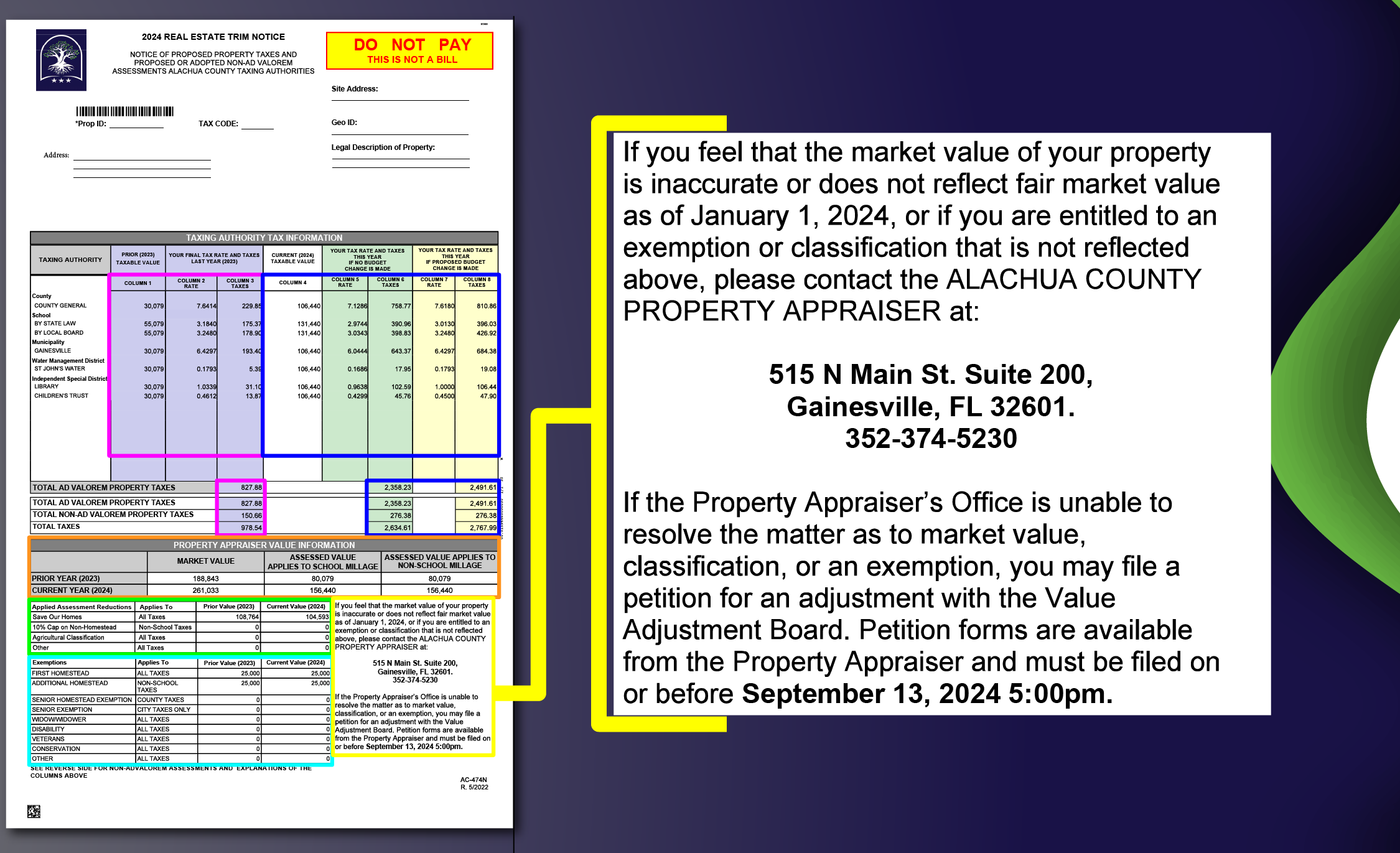

Contact information for the Property Appraiser’s Office and petition filing deadline.

*Back side of Notice*

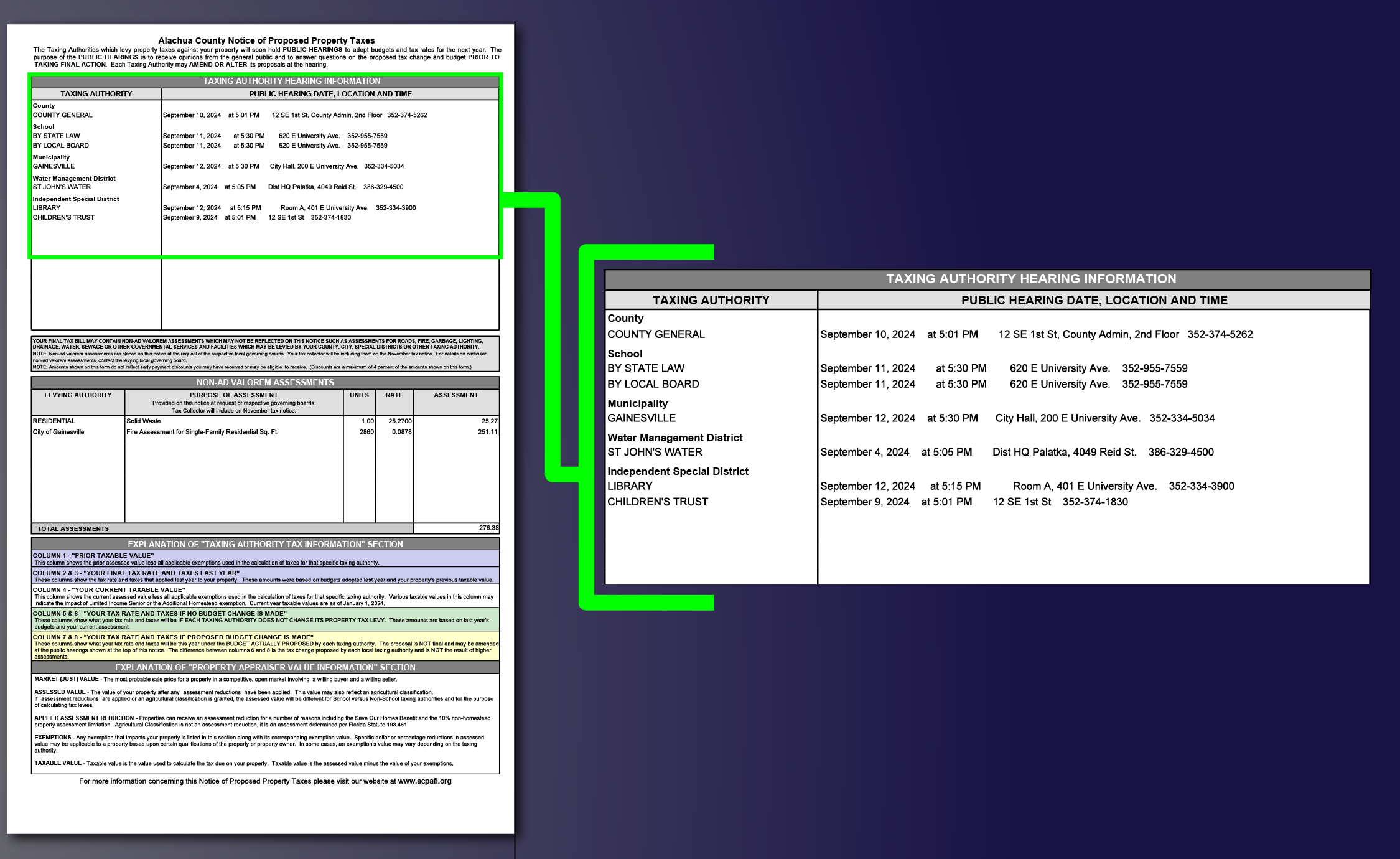

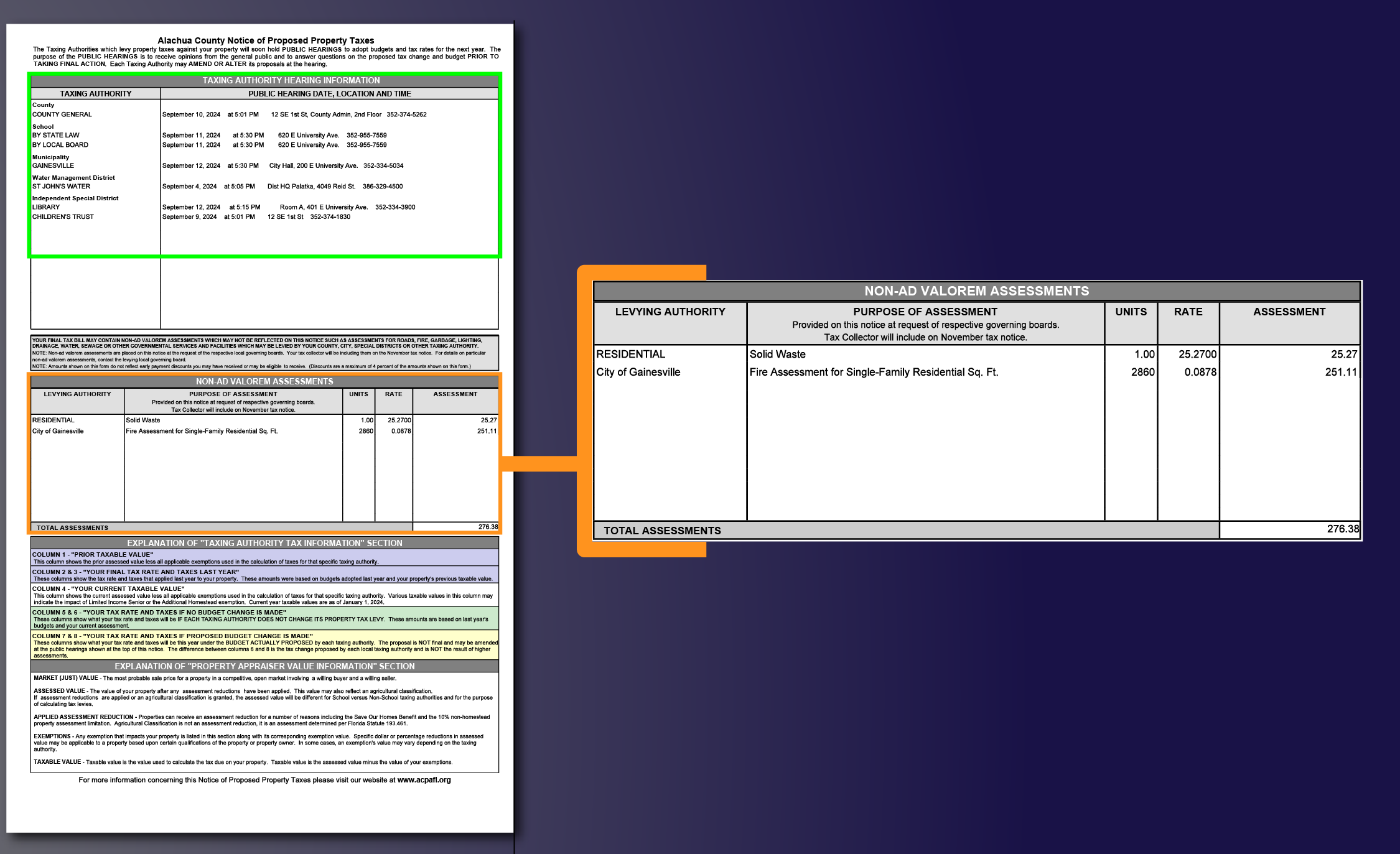

Column “Taxing Authority”: This is a list of the corresponding taxing authorities that are attached to this parcel.

Column “Public Hearing, Date, Location, and Time”; These are the dates times and locations for the public hearings about proposed millage rates (tax rates). This is open for you to provide input to the taxing authority before a final vote is taken.

*Back side of Notice*

Column “Levying Authority”: This is a list of the corresponding Non-Ad Valorem Levying Authorities that are attached to this parcel.

Column “Purpose of Assessment”: This is a list of reasons for the corresponding Levying Authority is taxing this parcel.

Columns “Units,” “Rates,” and “Assessments”: The units value is multiplied by the rate value to get the assessment value/ tax amount.

What to do if you disagree with your property value or exemption status

1) Informal Conference: If you believe your property value is higher or lower than the Property Appraiser’s estimate of market value on January 1, we encourage you to speak with an employee of our office at (352) 374-5230. Our goal is to produce accurate and equitable valuations and provide you with a thorough explanation of your property assessment and/or exemptions. We prefer to resolve any issues through an informal process. The Property Appraiser’s office will answer general questions on the phone immediately and refer specific valuation questions to our appraisers/specialists, who should respond to your inquiry within 24 hours. In most cases, an on-site inspection is necessary to determine any issues warranting an adjustment.

2) Formal Petition to the Value Adjustment Board: You have the option to file a petition with the Alachua County Value Adjustment Board (VAB) by the statutory deadline listed on the bottom of your TRIM notice. The VAB does not set millage rates and has no jurisdiction over taxes. Board appointed Special Magistrates can only address issues concerning values, classifications, exemptions, and portability. For more information or to download petition forms, please click here.

To file a completed petition, or for questions, please contact the Value Adjustment Board at:

Email: dmw@alachuaclerk.org

Website: https://alachuacounty.us/Depts/Clerk/VAB/pages/valueadjustmentboard.aspx

Phone: 352-374-3605

Fax: 352-374-5265

Millage Rates

Millage is a tax rate defined as the dollars assessed for each $1,000 of value; one mill is one dollar per $1,000 of assessed value. Mathematically the equation is: Taxable value ÷ 1,000 × millage rate = Property Tax Owed.

Who sets the millage rates? Taxing authorities. Taxing authorities are governed by the Florida Constitution and Statutes. They include county governments, school boards, water management districts, special districts and municipalities within a county. Taxing authorities adopt a budget and levy millage rates to fund that budget.

When are Millage Rates Set? Taxing authorities typically begin developing their budget in June. The official start is July 1 when they receive the total taxable value for their jurisdiction from the property appraiser. Tentative millage rates for taxing authorities other than school districts are set before August 5. Final millage rates for those taxing authorities are adopted in September. School districts follow an earlier schedule with their final millage rate being adopted in July.

Are there limits to how much millage rates can increase each year? Yes. Under the Florida Constitution and Statute, taxing authorities have approval requirements that escalate depending on how much the millage rate is and the amount of increase over the prior year’s millage rate. Once a taxing authority sets the tentative millage rate, they cannot adopt a higher millage rate without restarting the process, but they can adopt a lower millage rate. The vote to adopt the final budget and millage rate is at a duly advertised meeting in which the public may participate.

**In addition to the higher voting thresholds that are state-wide requirements, some Florida counties have passed local ordinances that limit millage rate increases.

Can a taxing authority adopt a lower millage rate? Yes. There are no state-wide restrictions related to millage rate decreases; a millage rate reduction can be approved with a simple majority vote.

If a millage rate is lowered will my property tax bill decrease? Not necessarily. There are several factors which can cause your tax bill to increase even if a taxing authority decreases its millage rate. If your taxable value has increased, it may offset any millage rate decrease. If other taxing authorities raise their millage rates, your overall tax bill may increase. Deferred value, as a result of your homestead exemption, can increase your taxable value even during periods of slow growth or market downturns.

At what point can taxpayers get involved in millage determinations? Taxpayers can take part in public hearings that take place in September when taxing authorities present and discuss tentative budgets and millage. Initial public hearing dates, times, and locations are provided on the second page of the TRIM Notice that the Alachua County Property Appraiser sends before August 25. Final public hearing dates, times, and locations are advertised to the public by each taxing authority.

Where can I get even more information about millage? The Florida Department of Revenue has a “Florida Homeowner’s guide: Millage” PDF that can be found here.

Where can I find up to date millage rates for Alachua County? You can find the up to date millage rates on our website here.

Taxing Authorities

The Taxing authorities are broken down into two different types “Ad Valorem” and “Non Ad Valorem”

- Ad Valorem Taxes — Proposed taxes based on the value of your property

- Non Ad Valorem Taxes — Proposed fees for services such as garbage, fire, and lighting

Please note that the Alachua County Property Appraiser does not set tax rates nor does it collect taxes. Questions concerning taxes should be directed to the Taxing Authority listed on your Notice

A full list of all the taxing authorities in Alachua County can be found on the millage rates page located here.

Your Property’s Information

You can view your property’s information via our “Property Searches” page. You can reach this page by clicking on the menu above or here.

Your property’s page will give you information about:

• Parcel Summary (Address, Parcel ID, Legal Description, Tax Area, Acres, if it is homesteaded, and more)

• Millage Rate Value (more info about millage rates can be found here.)

• Owner Information

• Valuation (the past 3 year’s information plus current year’s information about Land, Agricultural, Market, Assessed, Exempt, and Taxable Value. Also the Maximum Save our Homes Portability)

• Last two years TRIM Notice

• Land Information (Land use, Acres, Square feet, Depth, Zoning)

• Building Information (breakdown of the buildings information that we have on file)

• Sub Area

• Sales (List of historical sales information and links to the records from the Clerk of Courts)

• Area Sales Reports (Search sales by Neighborhood, Subdivision, or Distance)

• Permits

• Links to Tax Collector Records

• Sketches, Maps, and Photos

FAQ’s

What is a TRIM notice?

The 1980 Florida Legislature’s Truth in Millage Act was designed to inform taxpayers which governmental agencies are responsible for the property taxes levied. The Notice of Proposed Tax forms, also known as Truth in Millage (TRIM) notices, are prepared and mailed each year by the Property Appraiser on behalf of the taxing authorities pursuant to Florida law. Although the TRIM notice is not a tax bill, it is intended to notify property owners of possible changes that may appear on the November tax bill.

What are my rights as a taxpayer?

The 2000 Florida Legislature created the Taxpayer’s Bill of Rights for Florida property owners (s. 192.0105, F.S.). It guarantees that your rights, privacy, and property are safeguarded during the assessment, levy, collection, and enforcement of property taxes. The law also provides for the right to be notified of your assessment, and the right to an informal and formal appeal. It was intended to make the TRIM process very transparent.

How is the market value of my property determined?

The ad valorem assessment process is governed by Florida law, including s.193.011, F.S. Market (just) value is defined as the most probable sale price for a property in a competitive, open market involving a willing buyer and seller on January 1. The market value is unencumbered and may increase or decrease as the market dictates

How does Homestead Exemption affect my property value?

Homestead exemption is up to a $50,000 reduction in the assessed value of your property. It is granted to property owners who:

1) possess title to real property;

2) are bona fide Florida residents living in the dwelling and making it their permanent residence on January 1; and

3) file an initial application by March 1.

The first $25,000 of assessed value is entirely exempt from taxes. The additional $25,000 exemption (Amendment 1) applies only to the assessed value between $50,000 and $75,000, and is not exempt from school district tax levies. If your assessed value is between $50,000 and $75,000, a pro-rated exemption amount applies. If your assessed value is $75,000 or higher, you will receive full benefit of the additional $25,000 homestead exemption, except from school district tax levies

Can the proposed values, millage rates, and/or taxes on the TRIM notice change?

Yes. If you believe your property value or exemption status is incorrect, contact the Office of the Property Appraiser. We will review your property and provide you with a timely and thorough explanation. Corrections can be made for the current assessment roll. The millage rates displayed on the TRIM notice are last year’s millage rates, the rollback millage rates, and the proposed maximum millage rates. The proposed rates may be reduced by the taxing authorities prior to the November tax bills. If you have questions or concerns regarding millage rates or resulting taxing levels, contact your taxing authorities or attend the public hearings displayed on your notice.

Why are my taxes so much higher this year?

Annually properties are reassessed on January 1. If you purchased your property in 2023, it has been reassessed. All exemptions, along with a property cap(s) from the prior owner, have been removed, which may result in an increased property tax bill. Property taxes are subject to change upon change of ownership.

You can find the assessed value of your property and the exemptions applied to your property on Page 2 of your TRIM Notice.

Why are my neighbor’s taxes lower than mine?

A few different factors could contribute as to why your neighbor’s taxes are lower than yours.

One is the ”Save Our Home” cap, which limits any annual increase in the assessed value of the residential property with a Homestead Exemption to 3% or the amount of the Consumer Price Index, whichever is less. You can only begin to accumulate this benefit after filing for and being granted a Homestead Exemption, providing the market value increases over time.

Another factor is your neighbor may be eligible for additional exemptions on their homesteaded property.

How do I know if I have a Save Our Homes Cap?

If you have a Save Our Homes Cap benefit it will be identified on page 1 of your TRIM Notice under the “Applied Assessment Reductions” section. You start to accrue a Save Our Homes Cap after your first year of Homestead Exemption given the market value increases over time.

Where is my Portability listed on my TRIM Notice?

View your Portability/Assessment Reductions benefit on page 1 of your TRIM Notice.

What is the difference between Ad Valorem Taxes and Non-ad Valorem Assessments?

Ad valorem taxes are taxes whose amount is based on the value of property, exemptions, caps, and the millage rate set by each taxing authority.

Non-ad valorem assessments are special assessments or service charges that are not based on the value of the property multiplied by the millage rate. Non-ad valorem assessments are assessed to provide certain benefits to your property.